Fred Olsen Cruise Insurance - 2025 Review

Fred Olsen Cruise Insurance Review

7

Strengths

- Strong Insurance Partner

Weaknesses

- Only Available to UK Citizens

- In British pounds

Sharing is caring!

Family-run Fred Olsen Cruise Line is a traditional British-style line that accommodates hundreds rather than thousands of guests. The smaller ship size enables them to cruise to destinations larger ships can’t access such as canals and cruising rivers in the heart of European cities. They pride themselves on providing unique and personalized itineraries that have won them the Cruise Critic award for Best Itineraries every year since 2015.

Unfortunately, Fred Olsen Cruises does not offer a travel insurance option to US-based guests.

This article discusses your Fred Olsen cruise insurance options and what to look for in a trip insurance policy.

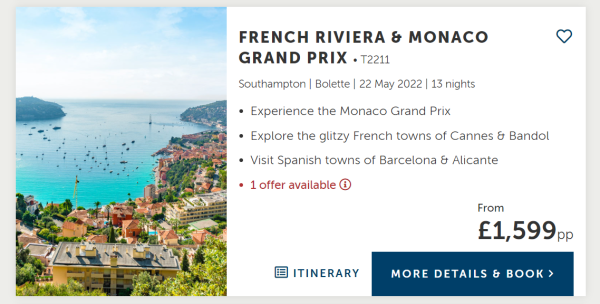

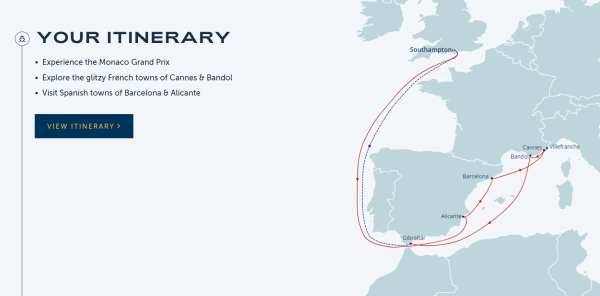

Sample Cruise Itinerary

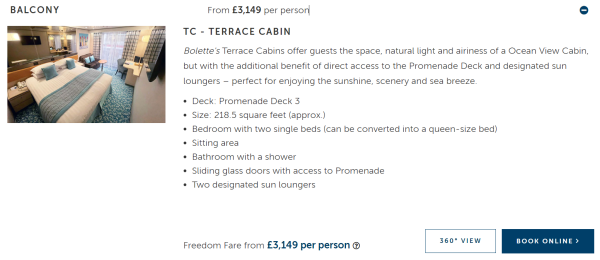

For our example, we chose a 13-night cruise that departs from Southampton, England, and travels to Spain and France before returning. Cruise dates chosen were 05/22/2022 – 06/04/2022. Travelers are two adults aged 55 and 60. The cruise price is $4,258.06 per person for a total of $8,516.12.

As airfare is purchased separately and pricing can greatly vary, this review includes only the cost of the cruise, instead of total trip cost including airfare.

What Are My Options for Travel Insurance?

Fred Olsen recommends purchasing travel insurance through their third-party partnership with Holiday Extras Ltd. However, you must be a resident of the United Kingdom to purchase their travel insurance.

Therefore, you need to buy travel insurance on your own. Although the cruise cost does not include travel insurance, Fred Olsen Cruise Lines requires that you have travel protection to board the ship.

TripProtectors Travel Insurance Marketplace lets you compare up to 30 policies from different carriers based on your specific needs. This saves you time and money as you don’t need to go to each individual insurance company for a quote.

Also, the travel insurance industry is highly regulated. The policy price must be the same, no matter where a traveler purchases a plan. Consequently, buying directly with the insurance company does not save you any money.

Comparison Quotes

When traveling outside the United States, TripProtectors recommends carrying a minimum of $100,000 in Medical Insurance, $250,000 in Medical Evacuation, and a Pre-existing Medical Condition Waiver. We used these criteria to choose the selected quotes.

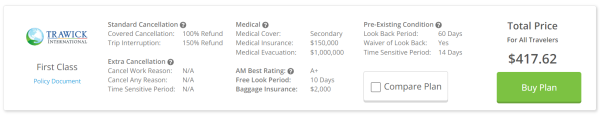

The least expensive plan with adequate coverage on our quote from TripProtectors is the Trawick First Class.

This Trawick policy allows for cancellation for the most common reasons such as: unforeseen illness, accidental injury, or death of a family member. However, some travelers want the ability to cancel for any reason without forfeiting their entire investment. A Cancel For Any Reason (CFAR) policy allows the insured to cancel for reasons not listed and still receive a partial refund. Trawick’s CFAR offers a 75% cash refund.

The Cancel For Any Reason (CFAR) policy that we chose for this comparison is the Trawick First Class (CFAR 75%). This is the most affordable CFAR policy that also contains the medical coverage limits that we recommend.

Next, we broke down the benefits of each policy in a side-by-side comparison.

|

Benefit |

Trawick First Class |

Trawick First Class (CFAR 75%) |

|

Trip Cancellation |

100% of trip cost |

100% of trip cost |

|

Trip Interruption |

150% of trip cost |

150% of trip cost |

|

Medical Insurance |

$150,000 |

$150,000 |

|

Medical Evacuation |

$1,000,000 |

$1,000,000 |

|

Baggage Loss/Damage |

$500/article up to $2,000 per person |

$500/article up to $2,000 per person |

|

Baggage Delay |

$400 |

$400 |

|

Travel Delay (Incl quarantine) |

$1000 per person |

$1000 per person |

|

Missed Connection |

$1,000 per person |

$1,000 per person |

|

Cover Pre-existing Medical Conditions |

Yes, if purchased within 14 days of deposit |

Yes, if purchased within 14 days of deposit |

|

Cancel For Work Reason |

No |

No |

|

Interrupt For Any Reason |

No |

No |

|

Cancel For Any Reason |

No |

75% of trip cost |

|

Accidental Death & Dismemberment |

$25,000 |

$25,000 |

|

Cost of Policy |

$417.62 (4.9% of trip cost) |

$709.95 (8.3% of trip cost) |

Trip Cancellation

Sometimes unexpected events interfere with your travel plans, forcing you to cancel your trip. Trip Cancellation reimburses you for your pre-paid and non-refundable trip costs if you must cancel your trip for a covered reason.

Most plans available from TripProtectors cover cancellation for:

- Unforeseen illness, accidental injury, or death (traveler, traveling companion, family member, or host)

- Inclement weather, strike, or mechanical delay of a common carrier

- Financial default of a common carrier

- Traffic accident en route to the destination

- Hijacking, quarantine, jury duty, subpoena

- Fire, flood, burglary, or natural disaster

- Documented theft of passport or visas

- Mandatory evacuation

- Called to military duty or revocation of leave

- Involuntary job termination or lay off

- Terrorism

Hopefully, none of these things happen, and you can leave for your vacation without a hitch.

Trip Interruption

A Trip Interruption is a situation during your trip that causes you to miss some or the rest of your vacation. It’s like Trip Cancellation but happens during your travels.

The most common trip interruption is the injury or illness of a traveler. If you had an injury or illness on your vacation but can continue traveling after treatment, trip interruption reimburses the unused portion of the trip, and the cost to rejoin the trip in progress.

Trip interruption also includes a family member who had a sudden grave illness or passed away. If your covered situation requires curtailing the trip and going home early, Trip Interruption also reimburses for the unused portion of the trip, plus the added cost of going home early.

Travel insurance plans like the Trawick First Class also offer 150% of trip costs for interruption. Therefore, they cover up to 100% of the unused costs, plus up to an additional 50% to cover transportation costs to return home.

Cancel For Any Reason

Cancel For Any Reason provides peace of mind against any uncertainty about traveling. This coverage helps you recover 50% - 75% (depending on policy) of your trip cost if you must cancel your travel plans for any reason not otherwise covered by the policy. Without it, you would lose all your pre-paid and non-refundable trip costs for a non-covered cancellation.

Suppose your main concern for cancellation is uncertainty about Covid rates at your destination. You may worry that you shouldn’t travel on your scheduled trip if your destination country sees a large spike in Covid rates. Even if your doctor advises against traveling, Trip Cancellation does not cover cancellation due to fear of traveling because of Covid concerns.

Travel insurance with Cancel For Any Reason is the only option. TripProtectors offers a variety of Cancel For Any Reason options for residents in most states.

There are some rules to keep in mind when purchasing a Cancel For Any Reason plan:

- You must insure 100% of your pre-paid and non-refundable trip costs

- You must purchase the policy within the Time Sensitive Period (10-21 days of the date you placed your initial payment or deposit towards the trip) and insure subsequent payments

- You must cancel your trip no later than 48 hours prior to departure

The Trawick First Class (CFAR 75%) will reimburse 75% of your trip cost should you cancel for a reason not listed in the policy.

Pre-Existing Medical Conditions

Travel insurance does not pay benefits for Pre-Existing Conditions. It’s a standard, industry-wide exclusion. However, many policies offer a waiver that adds coverage for Pre-Existing Conditions back into the policy. These policies typically must be purchased within 14-21 days (depending on policy) of the date you place your initial payment or deposit towards the trip. This timeframe is called the Time Sensitive Period.

The Trawick First Class plans will provide coverage for Pre-Existing Conditions if the policy is purchased within 14 days of your initial trip payment or deposit. Several other terms must also be met for all three policies:

- you are medically able to travel at the time the coverage is purchased; and - you insure 100% of your prepaid Trip costs that are subject to cancellation penalties or restrictions.

Medical Insurance If Sick or Injured Traveling

Travel Medical Insurance pays for medical treatment if you are injured or ill during your planned vacation. Even healthy people can be victims of an accident that requires costly care. A broken leg, a car accident, or even severe food poisoning can land you in the hospital.

If you plan overseas travel, it’s important to keep in mind most health insurance plans do not pay for medical treatment outside of the US. Even if your health insurance does provide some coverage while you travel, it may restrict the nature of care and provider.

Also, Medicare does not pay for treatment outside the US. While some Medicare supplements cover up to $50k for treatment, it is a lifetime limit and for emergencies only. In addition, you must pay a deductible and 20% copay.

In addition, you can’t count on universal health care in foreign countries to pay for your treatment. Citizens pay taxes for this privilege. If you are not a citizen of that country, you will pay full price for treatment at a private hospital, which can cost $3,000-$4,000 per day.

Consequently, we recommend that you travel with at least $100k Emergency Medical Insurance while traveling abroad

The Trawick First Class policies provide $150k for Medical Insurance.

Emergency Medical Evacuation Brings You Home

Emergency Medical Evacuation pays for transportation to a medical facility capable of treating your condition.

Typically, Emergency Medical Evacuation is uncomplicated, like a ground ambulance to the nearest hospital. However, Emergency Medical Evacuation can include a costly airlift by medical personnel.

If, after your condition is stabilized, it’s determined you need further treatment, Emergency Medical Evacuation transports you to a hospital near your home so you can recover.

When traveling outside the US, TripProtectors always recommends a policy that includes at least $250k of Emergency Medical Evacuation. This ensures you have enough financial protection, especially in a critical situation.

The Trawick First Class plans in this review exceed this recommendation and provide $1 million of Medical Evacuation coverage.

Conclusion

When shopping for travel insurance, it’s important to make sure the policy has sufficient Medical and Medical Evacuation benefits for overseas expeditions and includes coverage for Pre-Existing Conditions.

Though we cannot get Fred Olsen’s recommended insurance in the United States, we were able to find excellent policies at competitive prices through TripProtectors.

As such, we always recommend comparison shopping to find the best value for your money.

Will I Get a Better Deal Going Directly Through the Insurer?

No. Many don’t realize that they won’t find the same travel insurance plans available at a better price directly from the insurer. Travel insurance rates are state-regulated, and no one can change those rates.

Travelers can find the best plan to fit their travel needs by using a comparison site like TripProtectors to shop their options and find the appropriate coverage.

Next time you cruise, run a comparison quote with us and see how much money you can save on a similar or better policy. You can even run a sample quote before you book your cruise.

Questions? We would love to hear from you. Please stop by and chat with us, send an email, or give us a call at +1(650) 397-6592.

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

Pam S.

Easy to use

The website is very easy to use. I was very happy to have access to the AARP discount as well.

Carla Lehn

Amanda was very clear and helpful.

Amanda was very clear and helpful.

Jocelyn

No stress travel

Very nice and knowledgeable