National Geographic Travel Insurance - 2025 Review

National Geographic Travel Insurance

7

Strengths

- Reputable insurance partners

- Good Medical Evacuation coverage

Weaknesses

- Low Medical Insurance

- High Cost

Sharing is caring!

National Geographic Expeditions was founded in 1999 and hosts air, land, and sea travel adventures all over the world. They provide access to historical sites, knowledgeable tour guides, and local experts eager to share their expertise. By booking a trip with National Geographic, you help support the National Geographic Society’s conservation, exploration, research, and education projects around the globe.

Before departing, National Geographic strongly recommends guests obtain travel insurance.

Unfortunately, National Geographic does not include travel insurance with the cost of your trip. If you want National Geographic's plan, you must visit their insurance partner's website. USI Affinity Travel Insurance Services administers the plan, which is underwritten by Generali US Branch.

In this review, we look in detail at National Geographic’s travel insurance and compare it with other options available in the broader travel insurance market.

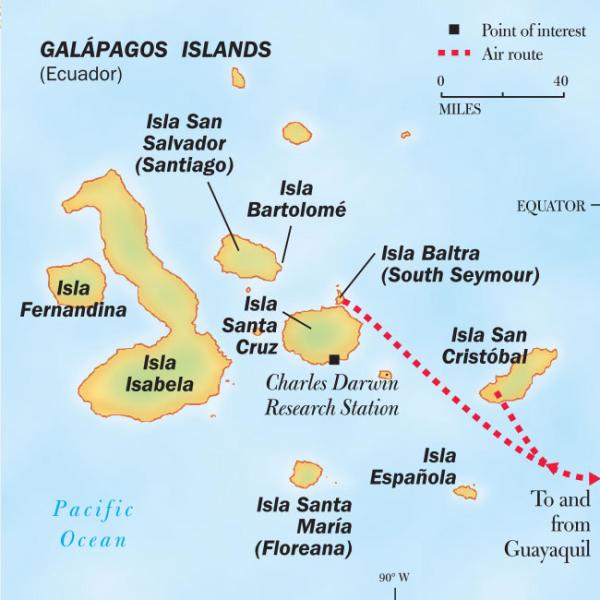

Our National Geographic Expeditions Cruise

For our example, our sample couple, ages 55 and 60, chose a 10-day Galapagos Voyage from 3/11/22-3/20/22. The price of the cruise is $7,710 per traveler, for a total of $15,420, including taxes and port fees.

While on the cruise, guests immerse themselves in the beauty of the Galapagos Islands and partake in a variety of activities, including nature walks, kayaking, snorkeling, swimming, and observing wildlife.

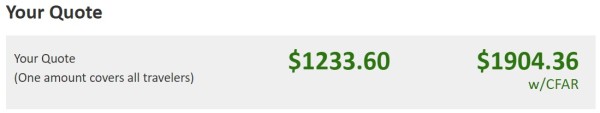

National Geographic Travel Insurance Cost

Based on a $15,420 trip cost, National Geographic’s standard cancellation plan would cost our two travelers $1,233.60. For the added piece of mind that comes with a Cancel For Any Reason plan, it would cost $1,904.36.

When we lasted reviewed National Geographic’s travel insurance, we were discouraged to see they did not offer a Cancel For Any Reason option. Updating our review led us to discover that Cancel For Any Reason is now available, but at a high cost.

Let’s look at what options are available on the wider travel insurance market.

Comparison Quotes

We use the same trip information to create a quote at TripProtectors. Our system provided 27 results for a variety of plans and insurers.

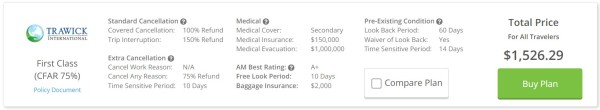

TripProtectors consistently recommends carrying at least $100k Medical Insurance, $250k Medical Evacuation, and a Pre-Existing Medical Condition Waiver when traveling outside the US. For this trip, the Trawick First Class plan is the least expensive policy that meets the recommended coverage amounts, at a total of $897.82 for both travelers – over $300 less than the National Geographic plan.

Next, we looked for the least expensive Cancel For Any Reason plan that meets our minimum recommended coverage, which is the Trawick First Class (CFAR 75%) for $1,526.29. This plan offers the same benefits as the Trawick First Class above but includes the added benefit of allowing you to cancel your trip for any reason not otherwise covered by the policy and receive a 75% reimbursement of your trip cost, for almost $400 less than the plan through National Geographic.

Given the difference in cost between National Geographic's plan and options available at TripProtectors, you can save a lot of money by investigating all your options.

Now, let's see how coverages compare to each other.

|

Benefit |

National Geographic Travel Insurance |

National Geographic CFAR Travel Insurance |

Trawick First Class |

Trawick First Class (CFAR 75%) |

|

Trip Cancellation |

100% of trip cost |

100% of trip cost |

100% of trip cost |

100% of trip cost |

|

Trip Interruption |

150% of trip cost |

150% of trip cost |

150% of trip cost |

150% of trip cost |

|

Medical Insurance |

$50,000 |

$50,000 |

$150,000 |

$150,000 |

|

Medical Evacuation |

$500,000 |

$500,000 |

$1,000,000 |

$1,000,000 |

|

Baggage Loss/Damage |

$2,000 |

$2,000 |

$500/article, up to $2,000 |

$500/article, up to $2,000 |

|

Baggage Delay |

$100 |

$100 |

$400 |

$400 |

|

Travel Delay (Incl quarantine) |

$2,000 ($250/day) |

$2,000 ($250/day) |

$1,000 |

$1,000 |

|

Missed Connection |

$1,500 |

$1,500 |

$1,000 |

$1,000 |

|

Cover Pre-existing Medical Conditions |

Yes, if purchased within 21 days of deposit |

Yes, if purchased within 21 days of deposit |

Yes, if purchased within 14 days of deposit |

Yes, if purchased within 14 days of deposit |

|

Cancel For Work Reason |

No |

No |

No |

No |

|

Interrupt For Any Reason |

No |

No |

No |

No |

|

Cancel For Any Reason

|

No |

75% of trip cost |

No |

75% of trip cost |

|

Accidental Death & Dismemberment |

$50,000 |

$50,000 |

$25,000 (common carrier) |

$25,000 (common carrier) |

|

Cost of Policy |

$1,233.60 |

$1,904.36 |

$897.82

|

$1,526.29 |

Price and Value

When reviewing travel insurance plans offered by cruise lines, we often find gaps in coverage. While National Geographic’s plan does offer good levels of coverage in many areas, it lacks sufficient Medical Insurance, which is critical for travel outside of the US.

TripProtectors recommends carrying at least $100k in Medical Insurance when traveling outside the country. National Geographic’s plan is insufficient in this area because only offers $50k in Medical Insurance. Alternatively, both Trawick First Class and Trawick First Class (CFAR 75%) provide $150k in Medical Insurance, at a lower cost.

Luckily, National Geographic’s plan offers adequate Medical Evacuation coverage, with a benefit of $500k. It also offers coverage for Pre-Existing Conditions, if purchased within 21 days of your initial payment or deposit towards the trip. Their plan did not include this coverage when we reviewed them before, so we’re happy to see that it’s now available.

On the other hand, Trawick First Class and Trawick First Class (CFAR 75%) will cover Pre-Existing Conditions if purchased within 14 days of your initial payment or deposit.

Next, we’ll discuss these points in more detail.

Trip Cancellation

Sometimes unexpected events interfere with your travel plans, forcing you to cancel your trip. Trip Cancellation reimburses you for your pre-paid and non-refundable trip costs if you must cancel your trip for a covered reason.

National Geographic's travel insurance plan covers cancellation for:

- Unforeseen illness, accidental injury, or death (traveler, traveling companion, family member, host, or service animal)

- Inclement weather, strike, or mechanical delay of a common carrier

- Financial default of a common carrier

- Traffic accident en route to the destination

- Hijacking, quarantine, jury duty, subpoena

- Fire, flood, burglary, or natural disaster

- Documented heft of passport or visas

- Mandatory evacuation

- Called to military duty or revocation of leave

- Involuntary job termination or lay off

- Terrorism

- Academic exam scheduled after policy purchase

- Unable to undergo vaccination or inoculation

- Organ transplant

- Adoption proceedings

When we review cruise line travel insurance plans, we typically find only a short list of covered reasons. However, we’re pleased to see National Geographic's list of covered cancellation reasons is comprehensive and on par with other Generali-backed policies we reviewed.

Hopefully, none of these things happen, and you can leave for your vacation without a hitch.

Trawick First Class covers 14 cancellation reasons, including most of the reasons covered by National Geographic. However, the Trawick First Class (CFAR 75%) will allow you to cancel for any other reason and still receive a 75% reimbursement of your trip cost.

We’ll discuss Cancel For Any Reason coverage further below.

Cancel For Any Reason

Cancel For Any Reason provides peace of mind against any uncertainty about traveling. This coverage helps you recover up to 75% of your trip cost if you must cancel your travel plans for any reason not otherwise covered by the policy. Without it, you would lose all your pre-paid and non-refundable trip costs for a non-covered cancellation.

Suppose your main concern for cancellation is uncertainty about Covid rates in your destination. You may worry that you should not partake in your scheduled trip if your destination country sees a large spike in Covid rates. Even if your doctor advises against traveling, Trip Cancellation does not cover cancellation due to apprehension to travel because of Covid concerns.

Travel insurance with Cancel For Any Reason is the only option. TripProtectors offers a variety of Cancel For Any Reason options for residents in most states.

There are some rules to keep in mind when purchasing a Cancel For Any Reason plan:

- You must insure 100% of your pre-paid and non-refundable trip costs

- You must purchase the policy within the Time Sensitive Period (10-21 days of the date you placed your initial payment or deposit towards the trip) and insure subsequent payments

- You must cancel your trip no later than 48 hours prior to departure

Both Trawick First Class (CFAR 75%) and National Geographic’s Cancel For Any Reason option will reimburse 75% of your trip cost in this scenario, given the rules above are followed.

Although we like that National Geographic now offers Cancel For Any Reason, it comes at a much higher cost than the Trawick First Class (CFAR 75%). It’s always beneficial to compare the options available on the wider travel insurance market.

Trip Interruption

While Trip Cancellation covers you before you depart, Trip Interruption covers you once you leave for your trip. It reimburses you for the unused portion of your trip costs and the cost to catch up to your trip, if you’re able, or return home early.

Trip Interruptions covers circumstances similar to Trip Cancellation. For example, suppose you fall and break your leg during one of your excursions. You certainly will not be able to continue the rest of your vacation.

Once the local hospital takes care of you, the physician will likely recommend you return home to recover. Trip Interruption reimburses you for the portion of the trip you did not use and covers the cost to travel home early.

Travel insurance also covers if your Trip Interruption is temporary and resolves before the end of your trip. You can claim the unused portion of the journey while hospitalized and the transportation costs to rejoin the trip.

Trip Interruption reimbursement ranges between 100-150% of the insured trip cost. Any amount above 100% helps cover transportation expenses. In this case, National Geographic’s plan and Trawick First Class cover a 150% benefit.

Pre-Existing Medical Conditions

Travel insurance does not pay benefits for Pre-Existing Conditions. It’s a standard, industry-wide exclusion. However, many policies offer a waiver that adds coverage for Pre-Existing Conditions back into the policy. These policies typically must be purchased within 14-21 days (depending on policy) of the date you place your initial payment or deposit towards the trip. This timeframe is called the Time Sensitive Period.

National Geographic’s plan defines a Pre-Existing Condition as:

A Sickness or Injury during the 90-day period immediately prior to your effective date for which you or your Traveling Companion:

(1) received, or received a recommendation for, a diagnostic test, examination, or medical treatment; or

(2) took or received a prescription for drugs or medicine.

Item 2 of this definition does not apply to a condition which is treated or controlled solely through the taking of prescription drugs or medicine and remains treated or controlled without any adjustment or change in the required prescription throughout the 90-day period before coverage is effective under this Policy.

Luckily, the plan will provide coverage for Pre-Existing Conditions if the following terms are met:

- coverage is purchased prior to or within 21 days of your initial deposit; and

b. you are medically able to travel at the time the coverage is purchased; and

c. you insure 100% of your prepaid Trip costs that are subject to cancellation penalties or restrictions.When we had reviewed National Geographic’s travel insurance in the past, the plan did not offer coverage for Pre-Existing Conditions, so we’re happy to see that has since changed.

For senior travelers, TripProtectors always recommends buying a policy that includes a Pre-Existing Condition Exclusion Waiver to close massive coverage gaps.

By comparison, Trawick First Class and Trawick First Class (CFAR 75%) include a Pre-Existing Condition Exclusion Waiver if you:

- Purchase within 14 days of your initial deposit date,

- Insure 100% of all prepaid and non-refundable trip costs; and

- Are medically fit to travel at the time of purchase

Medical Insurance If Sick or Injured Traveling

An area that National Geographic travel insurance earns low scores in is Medical Insurance.

Travel Medical Insurance pays for medical treatment if you are injured or ill during your planned vacation. Even healthy people can be victims of an accident that requires costly care. A broken leg, a car accident, or even severe food poisoning can land you in the hospital.

If you plan overseas travel, it’s important to keep in mind most health insurance plans do not pay for medical treatment outside of the US. Even if your health insurance does provide some coverage while you travel, it may restrict the nature of care and provider.

Also, Medicare does not pay for treatment outside the US. While some Medicare supplements cover up to $50k for treatment, it is a lifetime limit and for emergencies only. In addition, you must pay a deductible and 20% copay.

In addition, you can’t count on universal health care in foreign countries to pay for your treatment. Citizens pay taxes for this privilege. If you are not a citizen of that country, you will pay full price for treatment at a private hospital, which can cost $3,000-$4,000 per day.

Consequently, we recommend that you travel with at least $100k Emergency Medical Insurance while abroad.

Unfortunately, National Geographic insurance only provides $50k in Medical Insurance. That is just not enough to protect you in a critical health emergency. If you do not have adequate Medical Insurance, you could lose your retirement savings paying for hospitalization overseas instead of another trip.

However, both Trawick First Class and Trawick First Class (CFAR 75%) provide $150k for Medical Insurance.

Emergency Medical Evacuation Brings You Home

Emergency Medical Evacuation pays for transportation to a medical facility capable of treating your condition.

Typically, Emergency Medical Evacuation is uncomplicated, like a ground ambulance to the nearest hospital. However, Emergency Medical Evacuation can include a costly airlift by medical personnel.

After the doctors stabilize your condition and determine you need further treatment at home, you need transportation. Emergency Medical Evacuation transports you to a hospital near your home so you can recover.

When traveling outside the US, TripProtectors always recommends a policy that includes at least $250k of Emergency Medical Evacuation. This ensures you have enough financial protection, especially in a critical situation.

All three plans in this review meet or exceed this suggestion.

Conclusion

When shopping for travel insurance, it’s important to make sure the policy has sufficient Medical and Medical Evacuation benefits for overseas expeditions and includes coverage for Pre-Existing Conditions.

National Geographic’s travel insurance plan offers good levels of coverage in many areas, but lacks sufficient Medical Insurance, which is critical when traveling abroad.

We do have to give National Geographic Expeditions credit for the fact that their plan now does provide coverage for Pre-Existing Conditions and offers the option to include Cancel For Any Reason, as it didn’t in the past.

However, the coverage comes at a high cost. Their standard cancellation plan costs over $300 more than the standard Trawick First Class available at TripProtectors. Their Cancel For Any Reason plan is nearly $400 more than the Trawick First Class (CFAR 75%) we reviewed. Overall, we rate the National Geographic Expeditions insurance a 7 out of 10. As such, we always recommend comparison shopping to find the best value for your money.

Will I Get a Better Deal Going Directly Through the Insurer?

No. Many don’t realize that they won’t find the same travel insurance plans available at a better price directly from the insurer. Travel insurance rates are state-regulated, and no one can change those rates.Travelers can find the best plan to fit their travel needs by using a comparison site like ours to shop their options and find the appropriate coverage. Next time you cruise, run a comparison quote with us and see how much money you can save on a similar or better policy. You can even run a sample quote before you book your cruise. Questions? We would love to hear from you. Please stop by and chat with us, send an email, or give us a call at +1(650) 397-6592.

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

customer

Ease of finding the plans...good rates

Ease of finding the plans...good rates

customer

Good Options!

Good Options!

Stanley Greenberg

GREAT SERVICE

Miranda was exceptionally professional, knowledgeable and extremely helpful. She took her time and answered any question I asked. She explained the benefits of the policies and was able to guide me to the proper one to meet our needs. She's a great asset to your organization.