Norwegian Cruise Travel Insurance - 2025 Review

Norwegian Cruise Travel Insurance

7

Strengths

- Available at Check-Out

- Strong Insurance Partner

- Good Cancellation Protection

Weaknesses

- Incredibly Expensive

- Totally Inadequate Medical Cover

- Very Poor Medical Evacuation Cover

Sharing is caring!

Norwegian cruise line was founded in 1966 and is the third largest cruise line in the world. Norwegian currently operates 17 ships and has plans to release 6 more soon. For their 17 fleets, Norwegian offers BookSafe Travel Protection.

In our Norwegian Cruise Travel (NCL) Insurance Review, we will run through the different trip insurance options that Norwegian offers and compare them against the wider travel insurance market.

First, let’s review the critical reasons to buy cruise travel insurance, to explain the logic behind some of our recommendations.

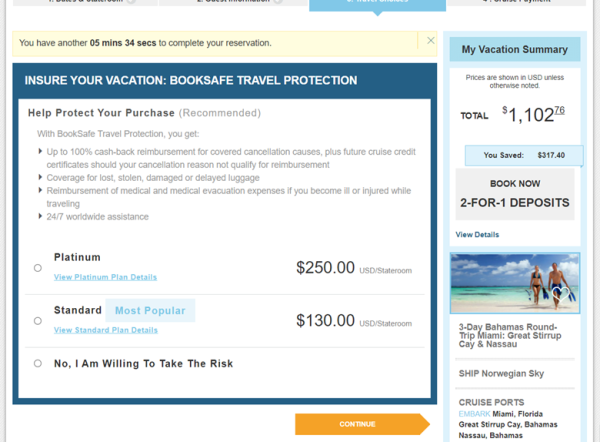

Norwegian Cruise Travel Insurance on Check-Out

For our review, we have two 62-year-old travelers going on a three-day cruise from Miami to the Bahamas. The total cost for the cruise came in at $1,102.76 for the two passengers.

As we get towards the check-out page, we are encouraged to buy Norwegian Cruise Travel Insurance. The exact image of what was presented is shown below. We are offered not one, but two cruise travel insurance options – ‘Platinum’ and ‘Standard’.

Don’t I Need to Buy Cruise Travel Insurance when I Buy My Cruise?

Every travel insurance policy has some ‘Time-Sensitive Benefits’ that are enabled when a traveler buys trip insurance within a short period of time after their initial trip deposit. This Time-Sensitive Period is normally 10-21 days. Generally, you have a couple of weeks to check out different trip insurance options. Get quotes from a few different travel insurance carriers to compare prices and benefits.

The main reason we want to get our cruise travel insurance in place sooner rather than later is that we get cancellation benefits once our travel insurance policy is in place.

Cruise Travel Insurance – Three Critical Benefits

Irrespective whether you buy Norwegian Cruise Travel Insurance, or buy a different travel insurance, there are three critical benefits that you really need to have in place.

- Cruise Cancellation Protection

- Travel Medical Health Insurance

- Medical Evacuation Coverage

Norwegian Cruise Cancellation Insurance Protection

Every comprehensive trip insurance policy has cancellation benefits built in. When we refer to ‘Cruise’ travel insurance, we really do mean regular, comprehensive travel insurance. Every major travel insurance carrier has comprehensive trip insurance policies that will support you if you are traveling on a cruise ship, by rail, or by aircraft. It doesn’t matter to the travel insurance carrier what type of vacation you are enjoying. So don’t get caught up in buying a travel insurance policy with ‘Cruise’ in the title.

Norwegian Cruise Travel Insurance is referred to by Norwegian as ‘Booksafe Travel Protection’, so even Norwegian does not worry about including ‘Cruise’ in the title of their coverage. Every trip and cruise insurance policy will have basic cancellation protection that should offer a 100% refund for the following types of events:

- Accident, illness, or death of you, a traveling partner, business partner, or family member • Jury duty • Legal appearance • Traffic accident en route to airport • Death or hospitalization of your host at your travel destination • Weather • Bankruptcy of your travel provider

On a cruise, death or hospitalization of a host at destination is not relevant. But bankruptcy of your travel provider is important. Norwegian’s does NOT include bankruptcy protection, so please be careful on this.

These events happen rarely, which is why travel insurance policies include basic trip cancellation coverage for little cost. Many of us, however, will want additional travel cancellation protection.

NCL Cancellation Protection – Work

Norwegian Cruise Travel Insurance does a good job in offering us a 100% refund if we are terminated or laid off from full-time employment by our company. This assumes that the reason for the lay-off is no fault of our own. This is good coverage from Norwegian – only one year of continuous employment is required. Most airline policies, for example, require three years of continuous employment, so Norwegian does a good job in this respect.

However, what is missing with Norwegian’s policy is protection if our work vacation is cancelled. Norwegian Cruise Travel Insurance offers no vacation cancellation protection, and we consider this as a significant weakness for anyone who requires approval to go on vacation. Strong Cancel for Work Reasons Travel Insurance would incorporate this coverage. Norwegian Travel Insurance does not, so please beware.

There is one higher level of cancellation protection than Cancel for Work – it is called Cancel for Any Reason Travel Insurance.

Norwegian Cruise Cancellation Protection – Cancel for Any Reason

If you buy Norwegian Cruise Travel Insurance, you will get Norwegian's version of Cancel for Any Reason protection built in. It is not, strictly, insurance, as you will not get your money back if you cancel. You will get a credit to be used for future cruises, which is a pretty good substitute.

Norwegian Cruise Travel Insurance offers two alternatives – Platinum or Standard. Standard will provide a credit of 75% of your funds if you cancel your cruise with Norwegian. You can then use these funds for a future cruise. Platinum offers a 90% credit. The coverage is expensive, but travelers may well benefit from it. A sensible alternative to Norwegian’s Cancel for Any Reason coverage would be the Cancel for Any Reason protection that is embedded into many Comprehensive Travel Insurance policies. We will show a few alternatives later in this article.

Travel Medical Health Insurance

Travel Medical Health Insurance is one of the most critical pieces of trip insurance that any traveler can have. It is essential, in our opinion. International private hospitals are not cheap and can often cost $3k to $4k per day. For this reason, we recommend that a traveler leaving the USA have at least $100k of Travel Medical Health Insurance in place.

Decent medical coverage is not expensive! Indeed, you will see this $100k figure in almost every comprehensive travel insurance available in the wider US market. The only time we are comfortable with less than $100k of travel medical insurance coverage is if the traveler has alternative insurance in place that the travel insurance can supplement. If you have any doubt - stick to $100k of Travel Medical Insurance coverage in any Travel Insurance, you buy.

Let’s look at all the coverage levels from Norwegian Cruise Travel Insurance. The price we see below is that quoted to us for our $1,102.76 cruise.

Norwegian Cruise Insurance Coverage - **Platinum**

$250 / Stateroom

- Trip cancellation or interruption for a covered reason - Total NCL vacation cost

- Trip Delay - $500

- Emergency Evacuation - $50,000

- Accidental Medical Expense - $20,000

- Sickness Medical Expense - $20,000

- Baggage / Personal Effects - $3,000

- Enhanced Cancellation Protection provided by NCL - 90% cruise credit

Norwegian Cruise Insurance Coverage - **Standard**

$130 / Stateroom

- Trip cancellation or interruption for a covered reason - Total NCL vacation cost

- Trip Delay - $500

- Emergency Evacuation - $25,000

- Accidental Medical Expense - $20,000

- Sickness Medical Expense - $20,000

- Baggage / Personal Effects - $1,500

- Enhanced Cancellation Protection provided by NCL - 75% cruise credit

The Norwegian Standard plan offers $20k in medical insurance. Norwegian Platinum Cruise coverage offers the same benefit, which is inadequate for an unforeseen medical emergency.

TripProtectors Travel Insurance Marketplace

It’s relatively simple to get alternative travel insurance options for your Norwegian Cruise. In fact, we need only one minute of your time. At TripProtectors, give us your travel details, and we share them anonymously with our Travel Insurance Carriers. You get a series of quotes, showing you rates and coverage levels, from some of the most respected Travel Insurance Carriers in the USA. We only work with carriers who have ‘A’ ratings from A.M. Best, and customer service levels that we are happy to recommend.

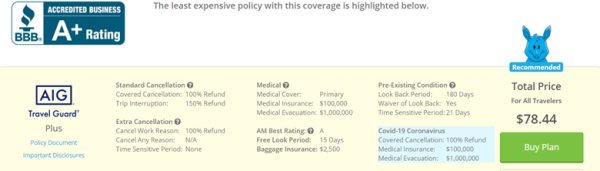

AIG Travel Guard Plus Insurance

One of our favorite low-cost travel insurance policies is the AIG Travel Guard Plus plan. Here are the protection levels incorporated into the policy.

Time-Sensitive Benefits • Cancel for Any Reason: 0% refund • Cancel for Work Reason: 100% refund • Preexisting Waiver: Yes • Time Sensitive Period: 21 days • Free Look Period: 15 days • Preexisting Look Back: 180 days Regular Benefits • Medical Coverage: Primary • Hospital of Choice: No • Covered Cancellation: 100% refund • Financial Default: Yes • Medical Sickness: $100,000 • Medical Evacuation: $1,000,000.

This travel insurance from AIG comes in at $78.44 for our two travelers. Yet, it has $100k of Travel Medical Health Insurance embedded into it. Let’s look now at our final piece of critical coverage – medical evacuation insurance.

Travel Medical Evacuation Insurance

Sometimes an accident or illness is so severe that a medical evacuation is necessary. We want to get the patient to the most suitable medical facility to treat them, and oftentimes this is not going to be in a small port city of an underdeveloped country. A medical evacuation can involve specially equipped private jets with associated doctors and nurses on board. A near-shore evacuation can cost $100k - $250k. An evacuation from Asia or Africa can easily cost $500k. These are the minimum levels of coverage that we ever recommend to a traveler. There is simply no logical reason in taking less protection than this.

Norwegian Medical Evacuation Coverage

So, what Travel Medical Evacuation coverage does Norwegian provide in its two policies?

- Standard - $25k

- Platinum - $50k

What level of medical evacuation coverage do we see in a low-cost travel insurance?

- AIG Travel Guard Plus - $1,000,000

Again, this is a massive increase in protection from what is one of our cheapest policies. The Norwegian Cruise Insurance is totally inadequate in this regard.

Cancel for Work and Cancel for Any Reason

Where the AIG Travel Guard Policy also rates well is that it offers work vacation cancellation protection. If your previously approved vacation is cancelled, AIG will provide a 100% refund of your non-refundable costs. From such a low-cost travel insurance policy, that is a great benefit. Remember, Norwegian Cruise Travel Insurance does not provide this protection.

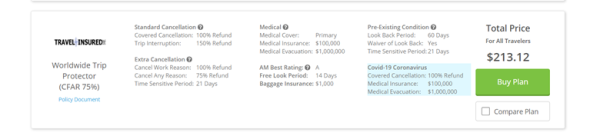

If you would like a policy with the optional benefit of Cancel for Any Reason trip cancellation protection, the Travel Insured WorldWide Trip Protector Plan is a great option.

It incorporates true Cancel for Any Reason protection. We say ‘true’ coverage, because if you need to cancel for any reason not normally covered by your other policy benefits, the insurer will write you a check for 75% of your trip costs. Cash is better than credit.

Here are the policy benefits:

Time-Sensitive Benefits

- Cancel for Any Reason: 75% refund

- Cancel for Work Reason: 100% refund

- Pre-Existing Waiver: Yes

- Time Sensitive Period: 21 days

- Free Look Period: 14 days

- Pre-Existing Look Back: 60 days

Regular Benefits

- Medical Coverage: Primary

- Hospital of Choice: Yes

- Covered Cancellation: 100% refund

- Financial Default: Yes

- Medical Sickness: $100,000

- Medical Evacuation: $1,000,000

Evacuation benefits are 50 times as much as Norwegian Cruise coverage. Medical coverage is five times as much. Travel Insured’s Medical coverage is Primary; Norwegian’s is Secondary. All this coverage costs 14% LESS than Norwegian’s Platinum coverage!

|

Benefit |

Norwegian Cruise Line Standard Insurance |

Norwegian Cruise Line Platinum Insurance |

AIG Travel Guard Plus |

Travel Insured WWTP (CFAR 75%) |

|

Trip Cancellation |

Total Cruise Cost |

Total Cruise Cost |

100% of trip cost |

100% of trip cost |

|

Trip Interruption |

150% of the Total Trip Cost |

150% of the Total Trip Cost |

150% of trip cost |

150% of trip cost |

|

Medical Insurance |

$20,000 |

$20,000 |

$100,000 |

$100,000 |

|

Medical Evacuation |

$25,000 |

$50,000 |

$1,000,000 |

$1,000,000 |

|

Baggage Loss/Damage |

$1500 |

$3000 |

$2,500 per person |

$1000 per person |

|

Baggage Delay |

$750 |

$750 |

$400 |

$300 |

|

Travel Delay (Incl quarantine) |

$500 |

$500 |

$1000 per person ($200/day) |

$1500 per person ($200/day) |

|

Missed Connection |

No |

No |

$1,000 per person |

$500 per person |

|

Covers Pre-existing Medical Conditions? |

No |

No |

Yes if purchased within 21 days of deposit |

Yes if purchased within 21 days of deposit |

|

Cancel For Work Reason |

No |

No |

100% of trip cost |

100% of trip cost |

|

Interrupt For Any Reason |

No |

No |

No |

75% of trip cost |

|

Cancel For Any Reason

|

75% Cruise Credit |

90% Cruise Credit |

No |

75% of trip cost |

|

Accidental Death & Dismemberment |

No |

No |

$30,000 |

$10,000 |

|

Cost of Policy |

$130 (11.79% of trip cost) |

$250 (22.68% of trip cost) |

$78.44 (7.11% of trip cost) |

$213.12 (19.32% of trip cost) |

Norwegian Cruise Travel Insurance Review – Conclusion

Norwegian offers two policies that are expensive, with little in the way of critical protection for some of the most expensive risks. We consider the policies that Norwegian offers to be unsuitable for almost all travelers. There are many other options available to cruise customers by searching within the wider travel insurance market. We rate Norwegian Cruise Line insurance a 7 out of 10.

Cruise Travel Insurance in the USA

The US has one of the most significant travel insurance markets on earth. At TripProtectors we take the leading Trip Insurance Carriers and place them in our marketplace. We offer you at least a dozen alternative policies from these leading insurers. The rates we show are the same as if you had gone direct to every travel insurer yourself. We do not mark up prices. In fact, US anti-discrimination law prevents such practices. As such, we can guarantee that you cannot buy the same policy at a lower rate.

Have questions? Chat with us online, send us an email at agent@TripProtectors.com or alternatively call us at +1(650) 397-6592. We would love to hear from you.

Safe Travels

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

Jocelyn

No stress travel

Very nice and knowledgeable

Orlando - paid customer

Getting travel insurance through the…

Getting travel insurance through the AARDY website was simple and easy. It took us several failed attempts and representative calls over a 5-day period on other sites. On AARDY, we were done and all paid up in 10 minutes. Excellent.

Yvonne Virginia Overcast

easily understood

easily understood