Oceania Cruises Travel Insurance - 2025 Review

Oceania Cruises Travel Insurance Review

7

Strengths

- Strong Insurance Partner

Weaknesses

- Limited Cancellation Reasons

- Very Low Medical Coverage

- Expensive

Sharing is caring!

Destination-rich itineraries and some of the finest culinary experience at sea are the hallmark of Oceania Cruises. Oceania Cruises set sail across the entire globe, with cruises which last anywhere from 10 to 46 days, stopping at over 450 ports throughout Africa, Australia, Europe, Asia, the South Pacific, and more. For the more adventurous travelers, Oceania Cruises also offer their grand 180-day Around the World Voyages. With six luxurious ships which carry no more than 1,250 guests, and with a seventh ship set for delivery in 2025, Oceania Cruises are an excellent choice for seasoned cruise travelers and first time cruisers alike.

With high-class service, luxurious cabins and award winning food, one would hope and expect Oceania Cruises trip insurance would protect their passengers with the same level of care that they take with their food, service, and ship.

However, TripProtectors has found that Oceania Cruises Travel Insurance coverage is lacking in many areas that we feel are crucial before embarking on a cruise vacation.

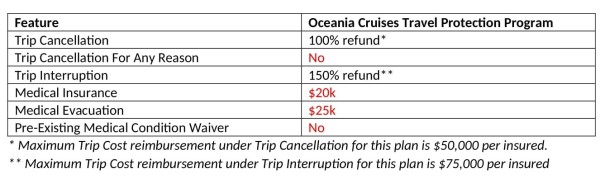

Overview of Oceania Cruises Travel Protection Program

The Oceania Cruises Travel Protection Program is underwritten by Nationwide, who we consider to be a strong insurance partner who underwrite many travel insurance policies across the industry.

Their Travel Protection Program offers many of the benefits and coverages normally expected to be found in a comprehensive travel insurance policy, and indeed contain many of the benefits found in the travel insurance policies offered at TripProtectors. Trip Cancellation, Trip Interruption, Medical Insurance, and Medical Evacuation are all included.

However, as is always the case, the devil is in the detail so we need to look at the limits for these common benefits.

If you are traveling outside of the United States, our team at TripProtectors advises travelers to carry a minimum coverage of $100,000 in Medical Insurance and $250,000 in Medical Evacuation. We also strongly suggest our travelers secure a policy which contains a Pre-existing Medical Condition Waiver if at all possible. Further, we advise that if traveling further afield to locations such as Asia or Africa or beyond, we recommend a minimum of $500,000 in Medical Evacuation cover.

In our opinion, the Oceania Travel Protection Program does not provide sufficient levels of coverage for international travel. We consider that the coverage level offered for Medical Insurance and Medical Evacuation are far too low for our comfort. Additionally, and an important piece of coverage for many senior travelers, the Oceania Travel Protection Program does not offer coverage for Pre-Existing Medical Conditions.

We’ll discuss these limits and coverages further later in our review.

Cost of Oceania Cruises Travel Protection Program

Coverage levels aside, we also need to determine if the Oceania Cruises Travel Protection Program offers good value for money compared to other plans available in the wider travel insurance marketplace. To do this we need to hoist the main sail and set off on a Oceania cruise.

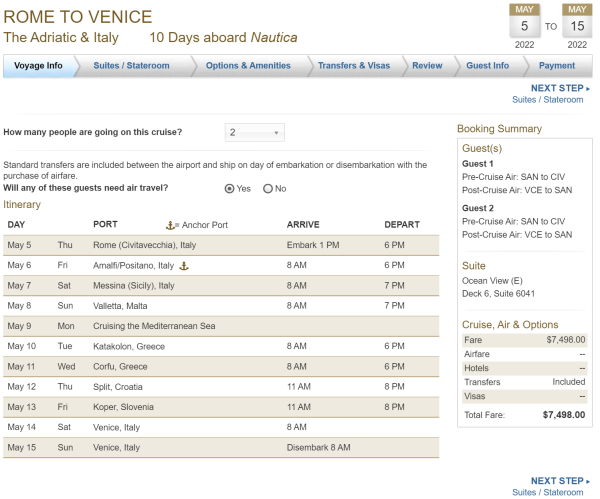

For our example, we chose a 10-day Oceania Cruise that begins in Rome, Italy and ends in Venice, Italy, with stops in Malta, Greece, Croatia, and Slovenia.

The cruise dates that we have chosen are 5/10/22 – 5/15/22, for two travelers. Our travelers are aged 55 and 60 and the cruise is priced at $3,749 per person, giving us a total cost of $7,498.

The Oceania Cruises Travel Protection Program costs $374.90 per traveler, for a total of $749.80, bringing the combined total cost for our travelers of the cruise and Travel Protection Program to $8,247.80.

Travel Insurance Alternatives to Oceania Cruises

Based on our sample couple, ages 55 and 60, we created a comparison quote with the policies offered through TripProtectors. The trip cost used for our comparison is the cruise cost for both travelers: $7,498.

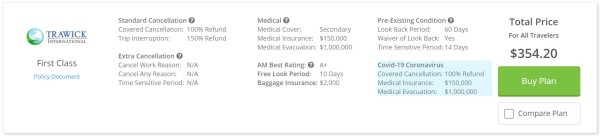

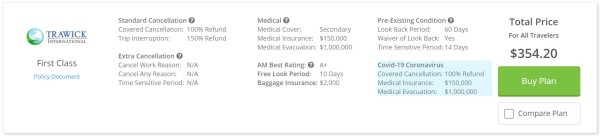

The least expensive plan with adequate coverage on our quote from TripProtectors is the Trawick First Class for $354.20.

For a Cancel For Any Reason policy, we selected the Trawick First Class (CFAR 75%), because it is the least expensive travel insurance plan which includes a Cancel For Any Reason (CFAR) benefit.

Now, we’ll take a look at the benefits of each policy in a side-by-side comparison.

|

Benefit |

Oceania Cruises Travel Protection Program |

Trawick First Class |

Trawick First Class (CFAR 75%) |

|

Trip Cancellation |

100% of trip cost, up to $50k |

100% of trip cost |

100% of trip cost, if for a covered reason |

|

Trip Interruption |

150% of trip cost, up to $75k |

150% of trip cost |

150% of trip cost |

|

Medical Insurance |

$20,000 per trip |

$150,000 per traveler |

$150,000 per traveler |

|

Medical Evacuation |

$25,000 per trip |

$1,000,000 per traveler |

$1,000,000 per traveler |

|

Baggage Loss/Damage |

$250/article up to $1,500 per trip |

$500/article up to $2,000 per person |

$500/article up to $2,000 per person |

|

Baggage Delay |

$500 per trip |

$400 |

$400 |

|

Travel Delay (Incl quarantine) |

$500 per trip |

$1,000 per person |

$1,000 per person |

|

Missed Connection |

No |

$1,000 per person |

$1,000 per person |

|

Cover Pre-existing Medical Conditions |

No |

Yes, if purchased within 14 days of deposit |

Yes, if purchased within 14 days of deposit |

|

Cancel For Work Reason |

No |

No |

No |

|

Interrupt For Any Reason |

No |

N/A |

No |

|

Cancel For Any Reason

|

No |

No |

Yes, if purchased within 10 days of deposit |

|

Accidental Death & Dismemberment |

No |

$25,000 |

$25,000 |

|

Cost of Policy |

$749.80 (10% of trip cost) |

$354.20 (4.7% of trip cost) |

$602.14 (8.1% of trip cost) |

From our side by side comparison it is clear that the Oceania Cruises Travel Protection Program offers minimal coverage and low limits of benefits compared to other plans available. What is especially noticeable is the difference in coverage levels for Medical Insurance and Medical Evacuation.

It goes without saying that Travel Medical Insurance is only effective when it can actually mitigate a worst-case scenario that may occur. If a travel plan doesn't have your back if the worst happens, you may bare any costs not covered by your plan. For that reason we recommend travelers who are venturing abroad should carry at least $100,000 in Medical Insurance. Although that may seem high, it’s important to note that international private hospitals can charge between $3,000 to $4,000 per day.

We also recommend that travelers should hold at least $250,000 in Medical Evacuation coverage for international travel. Travelers who are venturing even further from the United States, perhaps to Asia, Africa, or even Australia, would need a minimum of $500,000 in Medical Evacuation coverage. A medical air evacuation with doctors and nurses onboard can cost between $15,000 to $25,000 per flight hour, so it is extremely important to ensure you are properly protected for a worst-case scenario.

In addition to minimal coverage, the benefits offered through the Travel Protection Program are on a per trip basis, as opposed to per person benefits.

It is also very important to remember that the Oceania Travel Protection Program only covers the cost of the cruise fare, up to $50,000. This raises the question of how would a traveler protect other costs that they’ve paid out towards their trip? Put simply they would need to buy a standalone travel insurance plan to cover their airfares, transfers, excursions and car hire.

Not only do the Trawick First Class and Trawick First Class (CFAR 75%) plans offer far more benefits with higher per traveler limits at a lower cost, but they also allow our travelers to protect all of their other pre-paid and non-refundable trip costs that they’ve paid towards their trip, not just the cruise fare.

Cost Comparison

If our travelers purchase the Trawick First Class standard cancellation plan for $354.20 instead of the Oceania Cruises Travel Protection Program, our two travelers would save $395.60, which is a significant savings over the Oceania plan. If our travelers wanted the added piece of mind that comes with a Cancel For Any Reason policy, they could select the Trawick First Class (CFAR 75%) plan for $602.14 and still save $147.66 over the Oceania Cruises Travel Protection Program.

Whilst the Oceania Travel Protection Program does offer some coverage, it’s in our opinion it is simply not enough coverage for the price.

In the following sections, we’ll discuss these coverages in more detail.

Trip Cancellation

Trip Cancellation coverage protects a traveler from losing their pre-paid and non-refundable trip costs if they need to cancel their vacation due to covered reasons that is listed in the policy document.

Oceania Cruises Travel Protection Program has a short list of covered reasons:

- Your Sickness, Accidental Injury or death, that results in medically imposed restrictions as certified by a Physician at the time of Loss preventing Your participation in the Trip. A Physician must advise to cancel the Trip on or before the Scheduled Departure Date.

- Sickness, Accidental Injury or death of a Family Member or Traveling Companion booked to travel with You, that results in medically imposed restrictions as certified by a Physician preventing that person’s participation in the Trip.

- Sickness, Accidental Injury or death of a non-traveling Family Member.

- You or a Traveling Companion being hijacked, Quarantined, required to serve on a jury, subpoenaed, the victim of felonious assault within ten (10) days of departure;

- Having Your principal place of residence made Uninhabitable by fire, flood, volcano, earthquake, hurricane or other natural disaster;

- You or a Traveling Companion being directly involved in a traffic accident substantiated by a police report, while en route to departure

This is just too short of a list of reasons to cancel. TripProtectors recommends that cruise insurance policies also include:

- Your or Your Traveling Companion’s primary place of residence or destination being rendered uninhabitable and remaining uninhabitable during Your Scheduled Trip by fire, flood, burglary, or other Natural Disaster.

- Unannounced Strike that causes complete cessation of services for at least 12 consecutive hours of the Common Carrier on which You are scheduled to travel;

- Inclement Weather that causes complete cessation of services for at least 12 consecutive hours of the Common Carrier on which You are scheduled to travel;

- You or Your Traveling Companion or Your Family Member is in the military and called to emergency duty for a national disaster other than war;

- A Terrorist Incident that occurs within 30 days of Your Scheduled Departure Date in a city listed on the itinerary of Your Trip;

- Revocation of Your or Your Traveling Companion’s previously granted military leave or reassignment. Official written revocation/re-assignment by a supervisor or commanding officer of the appropriate branch of service will be required;

- Your family or friends living abroad with whom You are planning to stay are unable to provide accommodations due to life threatening illness, life threatening injury or death of one of them;

- Felonious assault of You or Your Traveling Companion within 10 days of the Scheduled Departure Date;

Many reasons can pop up to cause a traveler to cancel a trip, and although trip insurance can’t cover all the reasons that may come up, it should at least cover those listed above.

Trip Cancellation For Any Reason

In our reviews of other cruise lines travel protection plans, we often find that many of them include coverage for Cancel For Any Reason.

This benefit allows a traveler to cancel their trip for any reason that is not otherwise listed in the policy and still receive a large portion of their pre-paid and non-refundable costs back. Many cruise insurance plans will reimburse up to 75% of the pre-paid and non-refundable trip costs in the form of cruise credits, not cash.

Whilst we are never in favor of a cruise credit as opposed to a cash refund, the Oceania Cruises Travel Protection Program does not include a Cancel For Any Reason benefit of any kind, not even a cruise credit benefit, so the traveler has only a very limited amount of reasons to cancel

Trip Interruption

The Trip Interruption benefit will reimburse you for the unused portion of your trip if you need to interrupt your trip and/or return home early for any of the covered cancellation reasons that are listed in the policy. Trip Interruption coverage can also help with the added expense of getting home before your scheduled return date.

The Oceania Cruises Travel Protection Program states that up to 150% (with a maximum of $75k) of the trip cost listed in the policy, they will pay for:

- a) pre-paid unused, non-refundable land or sea expenses to the Travel Supplier;

- b) the airfare paid less the value of applied credit from an unused travel ticket, to return home, join or rejoin the original Land/Sea Arrangements limited to the cost of one-way economy airfare or similar quality as originally issued ticket by scheduled carrier, from the point of destination to the point of origin shown on the original travel tickets.

- The Company will pay for reasonable additional accommodation and transportation expenses incurred by You (up to $200 a day) if a Traveling Companion must remain Hospitalized or if You must extend the Trip with additional hotel nights due to a Physician certifying You cannot fly home due to an Accident or a Sickness but do not require Hospitalization. In no event shall the amount reimbursed exceed the amount You prepaid for the Trip.

Medical Insurance

The Medical Insurance cover will cover the costs associated with seeking medical treatment for an emergency illness or accidental injury that may occur whilst ony our trip. It is important to remember that most private health insurance plans, including Medicare, do not provide coverage outside of the United States, so Medical Insurance cover is critical for those are traveling internationally.

Oceania Cruises Travel Protection Program only offers cover of $20,000 for Accident Medical Expense and Sickness Medical Expense. At TripProtectors, we feel this coverage limit is far too low for adequate medical coverage when traveling overseas.

For international travel, TripProtectors recommends a traveler should carry at least $100,000 in medical coverage. While this may seem like a lot, an unexpected traumatic injury or illness overseas can often result in significant medical expenses, as international private hospitals can charge up to $3,000-$4,000 per day. Carrying travel medical insurance of at least $100,000 will ensure our traveler is covered for those unforeseen expenses.

Emergency Medical Evacuation

The Medical Evacuation benefit provides cover for expenses incurred for emergency transportation to a facility that is able to treat your medical emergency, or transport you back home to the United States, if deemed necessary.

The Oceania Cruises Travel Protection Program covers Emergency Medical Evacuation expenses up to $25,000 and covers the following:

- The Company will pay benefits for Covered Expenses incurred, up to the Maximum Benefit shown on the Confirmation of Coverage, if an Accidental Injury or Sickness commencing during the course of the Trip results in Your necessary Emergency Evacuation. An Emergency Evacuation must be ordered by a Physician who certifies that the severity of Your Accidental Injury or Sickness warrants Your Emergency Evacuation.

- Covered Expenses are reasonable and customary expenses for necessary Transportation, related medical services and medical supplies incurred in connection with Your Emergency Evacuation. All Transportation arrangements made for evacuating You must be by the most direct and economical route possible. Expenses for Transportation must be:

(a) recommended by the attending Physician;

(b) required by the standard regulations of the conveyance transporting You; and (c) authorized in advance by the Company or its authorized representative.

TripProtectors recommends travelers who are traveling within 3 to 4 hours of the United States border to carry a minimum $250,000 of Medical Evacuation benefits.

Travelers who are venturing further from home need a minimum of $500,000 for Medical Evacuation coverage – the cost of a long-range private jet staffed with a medical evacuation team.

In our opinion, $25,000 is an extremely low limit to offer for Medical Evacuation cover. This is a critical coverage to have in place, and for that reason, in our opinion the Oceania Cruises Travel Protection Program is not suitable.

Pre-Existing Medical Conditions

According to the Oceania Cruises Travel Protection Program, a Pre-Existing Medical Condition means an illness, disease, or other condition during the sixty (60) day period immediately prior to the Effective Date for which You, a Traveling Companion, or a Family Member booked to travel with You:

1) exhibited symptoms that would have caused one to seek care or treatment; or

2) received or received a recommendation for a test, examination, or medical treatment; or

3) took or received a prescription for drugs or medicine.

Item (3) of this definition does not apply to a condition that is treated or controlled solely through the taking of prescription drugs or medicine and remains treated or controlled without any adjustment or change in the required prescription throughout the sixty (60) day period before the Effective Date.

This pre-existing condition means that the Oceania Cruises Travel Protection Program specifically excludes coverage for pre-existing conditions. This means that there will be no Trip Cancellation, Trip Interruption or Medical Insurance coverage if a loss occurs that is caused by a pre-existing condition as defined in the policy.

All comprehensive trip insurance plans exclude pre-existing medical conditions. However, most policies will offer a waiver of this exclusion and will cover pre-existing conditions if the insurance is purchased within a Time Senstive period. This is a defined period of time after the first payment or deposit is placed on the trip.

Usually, this time sensitive benefit is available if the policy is purchased within 14-21 days (depending on the policy) of your initial payment or deposit. At TripProtectors we recommend having this coverage, if possible, as it does not cost anything extra and it is included in the policy, as long as you purchase within the Time Sensitive Period.

TripProtectors offers many plans that include this Pre-Existing Medical Condition Waiver.

We consider it to be very unfortunate that the Oceania Cruise Travel Protection Program does not include a Pre-existing Condition Medical Waiver, because most comprehensive travel insurance policies will provide a Medical Waiver when a traveler buys their policy promptly and insure all their pre-paid and non-refundable trip costs.

Our Conclusion

The Oceania Cruises Travel Protection Plan is lacking in many areas. Whilst it does have a strong insurance partner, the high cost and low coverage limits are not suitable for most travelers needs.

We spend a lot of money on cruises, and we sometimes book and pay for them months, or even over a year in advance of the departure date. This investment needs to be properly protected.

TripProtectors allows you to quickly get a quote based on your travel requirements, and shows a great set of products available from some of the top-rated travel insurance companies in the United States.

If I Go Directly to the Travel Insurance Company, Will I Get a Better Deal?

No, you will not get a better deal by going directly through the travel insurance company. Travel insurance is strictly regulated, and the policy rates are filed with each state. That means no one can sell a plan for more or less than the filed rates.

TripProtectors guarantees you will not find a lower price anywhere on any of the plans found on our site.

Questions?

Have questions? We would love to hear from you. Send us a chat, email, or call at +1(650) 397-6592.

Safe Travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

Pam S.

Easy to use

The website is very easy to use. I was very happy to have access to the AARP discount as well.

Carla Lehn

Amanda was very clear and helpful.

Amanda was very clear and helpful.

Jocelyn

No stress travel

Very nice and knowledgeable