Pearl Seas Cruises Travel Insurance - 2025 Review

Pearl Seas Cruises Travel Insurance - Review

6

Strengths

- Easy To Buy

Weaknesses

- High Cost

- High Cancellation Fees

- Not Travel Insurance - No Medical Insurance

- No Medical Evacuation

- No Trip Interruption Or Baggage Insurance

Sharing is caring!

Background

Pearl Seas Cruises offers unique, luxury cruises to Canada, the Great Lakes, and New England on a small ship of 210 guests. They state that they are “the premiere small cruise ship on the Canadian Maritimes, St. Lawrence Seaway, Great Lakes and the East Coast.” Due to the small guest size, they offer an intimate setting and personalized service as they cruise.

While most cruise lines offer comprehensive travel insurance policies, Pearl Seas is unusual in that it doesn't even provide insurance. Pearl Seas only provides a type of Cancellation coverage, no Medical Insurance or Medical Evacuation or any of the other benefits included in a standard comprehensive travel policy.

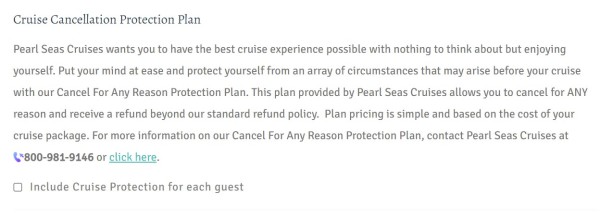

When you book your Pearl Seas cruise, you’re asked during the checkout process if you want to add their Cancel For Any Reason coverage. We’ll look at this cancellation coverage in greater detail in a moment.

Our Cruise: Canadian Maritimes and St. Lawrence Seaway

For purposes of this review, our sample couple, aged 60 and 55, booked a 15-night Canadian Maritimes and St. Lawrence Seaway cruise. It begins in Toronto, Ontario, and ends in Portland, Maine. Dates of travel: May 14,2022 – May 29,2022. Total cost for both travelers: $23.960 including port charges and fees. As airfare can vary significantly, we will only use the actual cruise costs in this review.

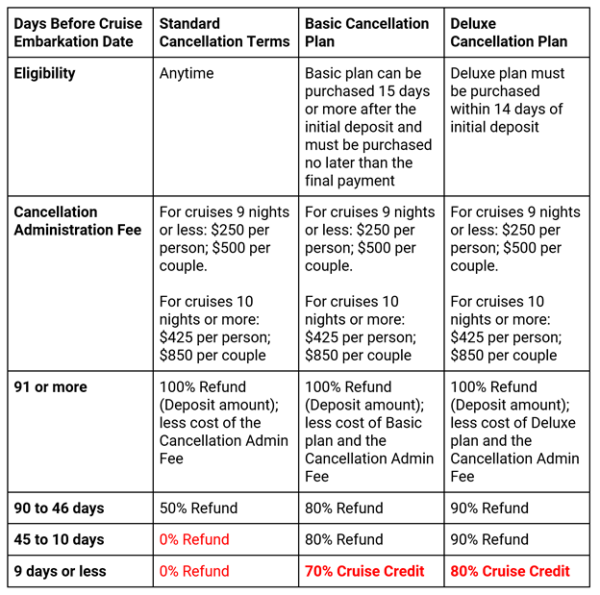

After choosing the stateroom and filling out the traveler information, we are immediately presented with the cancellation policy screen (see below):

As ‘Cruise Cancellation Protection’ is based on the trip cost and for our trip, if we choose to add it to our trip, the total cost for both our travelers would be $2,580.

What is included in this policy for $2,580? It entitles the traveler to reduced cancellation fees and nothing else.

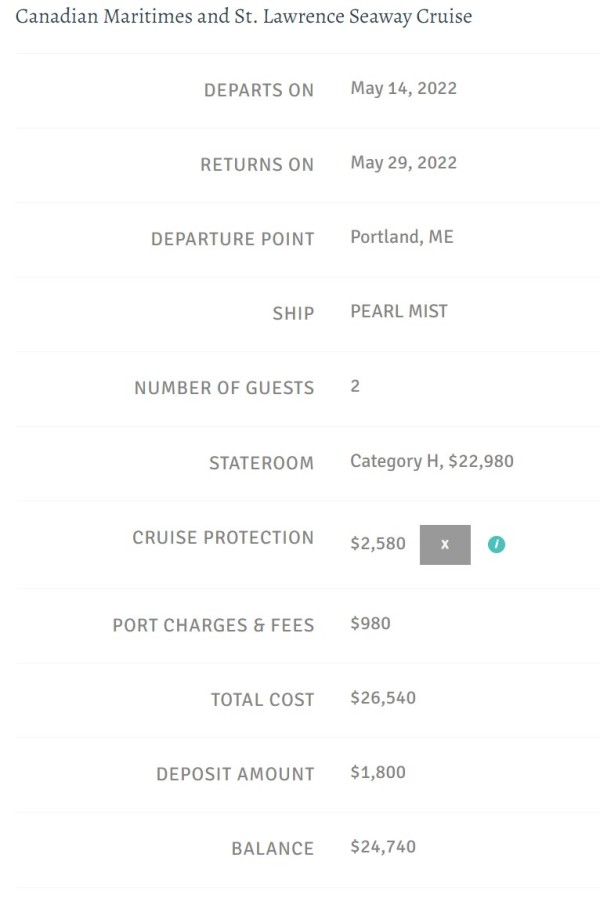

Depending on when you choose to purchase the Cancellation coverage, you will be placed into either the ‘Basic Plan’ or the ‘Deluxe Plan’.

In effect, the Basic and Deluxe Vacation Protection plans are the same price but have different eligibility periods. You receive the Deluxe plan when you buy it within 14 days of your initial trip payment. After that, you receive the Basic program until the final payment. After the final payment, you cannot get a cancellation plan from Pearl Seas Cruises.

Below is the refund schedule for the policies:

To reduce confusion, we’ve summarized the Pearl Seas Cancellation Policy below:

As you can see, the Pearl Seas’ cancellation policy is needlessly complicated. Pearl Seas still charges a cancellation fee regardless of whether you buy their Cancel For Any Reason Protection Plan or not. On cruises 9-nights or less, the fee is $500 per couple. For cruises 10-nights or more, it’s $850 per couple. Be aware that this cancellation fee might cost more than the deposit, so you could end up paying Pearl Seas to cancel!

Deciding to forego the Cancel For Any Reason Protection Plan can be risky too. If you cancel 45 days up to the date of travel, you will get NO REFUND at all of your trip costs with Pearl Seas. With the Cancellation coverage (Deluxe or Basic), if you cancel 90 days or less before the sail date, Pearl Seas Cruises reimburses only a portion of your money. Therefore, any cancellation, even a traveler’s injury, illness, or death, pays an 80%-90% refund with the Deluxe plan and repays a 70-80% with Basic.

In fact, with nine days or less until the cruise, Pearl Seas penalizes you with cruise credit instead of cash. For instance, if you tripped walking out to the mailbox and broke your ankle three days before your trip, Pearl Seas cruise cancellation doesn’t refund your money. Instead, they give you a future credit that expires if you don’t use it within 12 months.

Finally, Pearl Seas does not protect any travel arrangements made outside their company. If you arranged flights directly with an airline, you have to buy another policy to cover those cancellation costs as well because Pearl Seas doesn’t cover that cost.

At first glance, it seems like it might be a good decision to pay the $2,580 additional to be able to get even a partial refund of the trip costs back from Pearl Seas. But as we’ll see, they may or may not refund trip costs to you depending on the date of cancellation and circumstances. Actual travel insurance can not only provide more robust cancellation protection but will include medical coverage, medical evacuation, and other benefits we need at a lower cost.

Comparison Quotes

We used the same trip information to create a quote at TripProtectors. Our system provided 18 results for comprehensive travel policies from various insurers.

TripProtectors consistently recommends carrying at least $100k Medical Insurance, $250k Medical Evacuation, and a Pre-Existing Medical Condition Waiver when traveling outside the US.

For this trip, the AIG Travel Guard Plus plan is the least expensive policy that meets the recommended coverage amounts, for a total of $1,134.06 for both travelers – over $1,445 LESS than the Pearl Seas’ Cruise Protection Plan. The AIG plan also provides $100,000 per person of medical coverage and $1 million of medical evacuation coverage, as well as coverage for pre-existing medical conditions if the plan is purchased within 21 days of the initial trip deposit or payment date. It also includes robust trip cancellation reasons, none of which are available with the Pearl Seas’ plan.

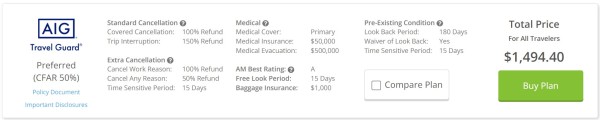

Next, we looked for the least expensive Cancel For Any Reason plan that meets our minimum recommended coverage, which is the AIG Travel Guard Plus (CFAR 50%) for $1,494.40.

This plan provides the same $100,000 of medical coverage and $1 million of medical evacuation coverage as does the standard AIG Travel Guard Plus policy but includes the added benefit of allowing you to cancel your trip for any reason not otherwise covered by the policy and receive a 50% reimbursement of your trip cost, for over $1,085 LESS than the Pearl Seas’ Cruise Protection Plan.

Both AIG plans allow you to cancel for medical reasons, including testing positive for COVID prior to the trip.

For a cost of $2,580 with Pearl Seas, you receive no medical coverage, no medical evacuation, no coverage for pre-existing medical conditions and if you need to cancel you will be charged a penalty fee the amount of which will depend on how far in advance you cancel. The coverage is truly disappointing and much more expensive than a travel insurance plan with robust coverage!

Given the difference in cost between the Pearl Seas’ Protection Plan and options available at TripProtectors, you can save a lot of money and have true trip insurance by investigating all your options.

Next, we’ll look at the benefits of each policy in a side-by-side comparison.

|

Benefit |

Pearl Seas Protection Plan |

AIG Travel Guard Plus |

AIG Travel Guard Plus (CFAR 50%) |

|

Trip Cancellation |

0% - 100% of prepaid costs less penalty and cost of protection plan (amounts dependent on date of cancellation) |

100% of trip cost |

100% of trip cost |

|

Trip Interruption |

N/A |

150% of trip cost |

150% of trip cost |

|

Medical Insurance |

N/A |

$100,000 |

$100,000 |

|

Medical Evacuation |

N/A |

$1,000,000 |

$1,000,000 |

|

Baggage Loss/Damage |

N/A |

$500/article up to $2,500 per person |

$500/article up to $2,500 per person |

|

Baggage Delay |

N/A |

$400 |

$400 |

|

Travel Delay (Incl quarantine) |

N/A |

$1000 per person |

$1000 per person |

|

Missed Connection |

N/A |

$1,000 per person |

$1000 per person |

|

Cover Pre-existing Medical Conditions |

No |

Yes if purchased within 21 days of deposit |

Yes if purchased within 21 days of deposit |

|

Cancel For Work Reason |

No |

Yes |

Yes |

|

Interrupt For Any Reason |

No |

No |

No |

|

Cancel For Any Reason

|

No |

No |

50% of trip cost |

|

Accidental Death & Dismemberment |

N/A |

$50,000 |

$50,000 |

|

Cost of Policy |

$2,580 (10.76% of trip cost) |

$1,134.06 (4.73% of trip cost) |

$1,494.40 (6.24% of trip cost) |

Cost Comparison

Overall, the Pearl Seas Protection Plan provides no significant benefits for the high price. Their Cancel for Any Reason isn’t a true Cancel for Any Reason benefit as you can’t cancel for a medical reason and receive a refund. Any cancellations are subject to a penalty fee prior to refund. Trip costs incurred outside of Pearl Seas, such as airfare are not covered nor refunded.

By shopping for cruise insurance through TripProtectors, our two travelers can save anywhere from $1,085 – $1,445, which can be applied to airfare, additional excursions, or shopping.

In the following sections, we discuss know what to look for when shopping for travel insurance for your Pearl Seas cruise.

Trip Cancellation

A significant concern for travelers is Trip Cancellation. If you became ill or had an accidental injury prior to your departure date, you may have to cancel your travel arrangements, resulting in financial losses. While disappointing, Trip Cancellation is doubly painful without cancellation insurance.

In contrast to Pearl Seas Cruises, travel insurance policies include a list of covered Trip Cancellation reasons which reimburse 100% of trip costs if a traveler must cancel.

Standard trip insurance policies have 10-12 cancellation reasons, while higher tier policies cover 18-26 circumstances. Of course, the more reasons for cancellation, the more flexibility you enjoy.

Travel insurance refunds 100% of your money in the following situations:

- Unforeseen injury, illness or death of a traveler or traveling companion

- Unexpected grave illness or death of a family member

- Hijacking, quarantine, jury duty, subpoena

- Traveler’s home uninhabitable due to fire, flood, natural disaster or burglary

- Involved in a traffic accident en route to departure point

- Strike of common carrier

- Inclement weather or mechanical breakdown causing delay of common carrier

- Involuntary termination or layoff

- Terrorism

Moreover, many middle and high tier policies cover these additional reasons for 100% refund cancellation:

- Mechanical breakdown of common carrier

- Traveler’s destination uninhabitable or inaccessible due to fire, flood or natural disaster

- Traveler’s place of employment unsuitable for business due to fire, flood, burglary, or natural disaster and required to work as a result

- Theft of passport or visa

- Permanent transfer of employment of 250 miles or more

- Government-mandated shutdown of airport or air traffic control due to natural disaster

- Mandatory evacuation at destination

- Traveler called to military duty for natural disaster (not war)

- Revocation of military leave due to war

- Bankruptcy or Default of an airline, cruise line, tour operator

- Traveler required to work during the trip

- Hurricane warning at destination

- Trip delayed so long 50% or more of the trip is lost

Both the AIG Travel Guard policies can cover all travel arrangements, regardless of where you booked them. In addition, they both offer a 100% refund for covered Trip Cancellations, a 150% refund for covered Trip Interruptions, and a broad list of covered reasons, including cancelling due to contracting COVID.

Trip Interruption

A Trip Interruption is a situation during your trip that causes you to miss some or the rest of your vacation. It’s like Trip Cancellation but happens during your travels.

The most common trip interruption is the injury or illness of a traveler. If you had an injury or illness on your vacation but can continue traveling after treatment, trip interruption reimburses the unused portion of the trip, and the cost to rejoin the trip in progress.

Trip interruption also includes cutting a trip short due to a family member who had a sudden grave illness or passed away. If your covered situation requires curtailing the trip and going home early, Trip Interruption also reimburses for the unused portion of the trip, plus the added cost of going home early.

Pearl Cruises does not provide any coverage for trip interruption. However, travel insurance plans like the AIG Travel Guard Plus and AIG Travel Guard Plus (CFAR 50%) offer a 150% refund for Trip Interruption. That amount includes reimbursement of unused trip costs plus the added cost of transportation home.

Cancel For Any Reason

Cancel For Any Reason cruise insurance provides the highest level of flexibility and reimbursement if you must cancel your trip for any reason not covered by the policy.

The Pearl Seas Protection Plan does have true Cancel For Any Reason benefits included in the policy. You can cancel your trip and depending upon when you cancel, you will be refunded a portion of your prepaid trip costs less a penalty fee of either $250 per person or $425 per person. However, if you cancel your trip 45 days or less with their standard policy you receive NO REFUND and with the Basic or Deluxe Cancellation Plan if you cancel within 9 days of travel they will only provide percentage refund in cruise credits (valid for 12 months), not cash. When it comes to cruise credits or cash, we always prefer cash.

Cruise credits might work for some, but what if this was the only time you could travel, or you became unable to travel and could not use the future travel certificates? Keep in mind that most cruise travel insurance works this same way.

Alternatively, travel insurance policies like the AIG Travel Guard Plus (CFAR 50%) pays a 50% cash refund of all prepaid, non-refundable trip costs including arrangements made outside of Pearl Seas. This could include flights, hotels, rental cars, excursions, and transfers.

Cancel For Any Reason policies in general have several stipulations:

- Purchase the policy within 10 - 21 days (depending on policy), of your initial payment or deposit date and

- Insure 100% of the prepaid trip costs subject to cancellation penalties or restrictions. For additional prepaid non-refundable payments made after the purchase of the policy, insure within 10-21 days (depending on policy), of each subsequent payment added to your trip, and

- Cancel your trip 2 days or more before your scheduled departure date.

Medical Insurance for Emergency Treatment

One of the most important factors in selecting trip insurance is having adequate Medical Insurance when you travel. Anything can happen, including accidental injuries or sudden illness.

If you have a medical emergency when traveling and don’t have proper medical insurance coverage while overseas, you could find yourself with huge, unexpected hospital bills. Many Americans mistakenly believe countries with universal health care will treat them for free. Unfortunately, this is not the case.

Instead, Americans receive treatment at private hospitals, not public, and must pay like anyone else. Admission for inpatient care can cost $3,000-$4,000 per day, plus the cost of treatment, x-rays, surgeries, and specialists.

A common misconception is that Medicare will pay for hospitalization overseas. Unfortunately, they won’t. Medicare does not pay providers outside the US. Some Medicare supplements do cover overseas, but have lifetime limits or reduced benefits, and pay for emergencies only. They can still require you to pay 20% of the costs. As a result, you could go on vacation and end up with medical bills in the thousands.

TripProtectors urges overseas travelers to take travel medical insurance of at least $100,000 per person. In a medical emergency, $100,000 provides ample health care and helps protect your retirement savings from unexpected financial burdens.

The Pearl Seas Protection Plan does not provide any medical coverage. Therefore, if you are ill or injured prior to the trip or during it, you will be paying either through any US healthcare (if applicable) or out-of-pocket. For a serious illness or injury, this could deplete saving or retirement funds quickly.

The AIG Travel Guard Plus policies include $100,000 per person of Medical Insurance, so you can receive proper treatment without ending up in debt.

Photo by Julius Silver - Pexels

Emergency Medical Evacuation

Medical Insurance isn’t the only potentially expensive part of a trip. Emergency Medical Evacuation transports you from the place of injury or illness to the closest hospital. Once you’re stable enough for transport, Medical Evacuation brings you home via commercial flight or, if necessary, private medical jet.

Medical flights can cost up to $25,000 per hour and regular health insurance does not cover it. In addition, the US State Department does not offer any medical treatment or evacuation assistance for US citizens. TripProtectors advises travelers to get at least $250,000 Medical Evacuation> to assure there’s enough coverage to get them back home from almost anywhere if they experience a serious medical event.

Once again, the Pearl Seas Protection Plan does not provide any coverage for medical evacuations. If you require a medical evacuation for an emergency medical situation, you will be paying out-of-pocket unless your US healthcare will provide some evacuation coverage (most don’t).

Aardy recommends at least $250,000 of emergency medical evacuation if traveling within several hours from US borders, or $500,000 if traveling to a more remote area of the world.

Both the AIG Travel Guard Plus and the AIG Travel Guard Plus (CFAR 50%) provide $1,000,000 per person for Medical Evacuation, so you can feel secure knowing you have adequate coverage to transport you back home if needed.

Pre-existing Medical Conditions

A significant concern for senior travelers can be pre-existing medical conditions. A Pre-Existing Medical Condition is one in which you’ve received medical treatment, testing, medication changes, added new medications, or received a recommendation for a treatment or test that hasn’t happened yet. Most travel insurance policies exclude pre-existing conditions unless you purchase the policy within the required time period from your initial trip deposit date (called the Time Sensitive Period). Otherwise, the insurer will look backward 60, 90, or 180 days (depending on the policy) from the date you purchased the insurance to see if there are any pre-existing medical conditions they won’t cover. This is called the Look Back Period. Any medical conditions older than this Look Back Period, unchanged or stabilized with no medication dosage changes are covered, as are any new conditions that arise after you purchase the policy.

If you must cancel, interrupt, or seek medical treatment for a medical condition while traveling, travel insurance policies typically exclude claims related to Pre-existing Medical Conditions. However, if you purchase the policy within a few days of your Initial Trip Payment or Deposit date, many policies add a Waiver to the policy that covers Pre-existing Conditions. As a result, there is no Look Back Period and Pre-existing Conditions are covered.

The Pearl Seas Protection Plan does not cover Pre-Existing Conditions. However, the AIG Travel Guard Plus and the AIG Travel Guard Plus (CFAR 50%) policies will cover or waive Pre-Existing Medical Conditions provided you purchase the policy within 21 days of the initial trip payment or deposit.

Price and Value

Remember, at TripProtectors, we recommend a minimum coverage:

- $100k Emergency Travel Medical Insurance

- $250k Emergency Medical Evacuation Insurance

- Pre-Existing Medical Condition Exclusion Waiver

Pearl Seas Protection Plan - $2,580

- No Emergency Travel Medical Insurance

- No Emergency Medical Evacuation Insurance

- No Pre-Existing Medical Condition Exclusion Waiver

AIG Travel Guard Plus - $1,134.06

- $100k Emergency Travel Medical Insurance

- $1m Emergency Medical Evacuation Insurance

- Pre-Existing Medical Condition Exclusion Waiver – Included

AIG Travel Guard Plus(CFAR 50%) - $1,494.40

- $100k Emergency Travel Medical Insurance

- $1m Emergency Medical Evacuation Insurance

- Pre-Existing Medical Condition Exclusion Waiver – Included

- 50% cash refund under cancel for any reason

The Pearl Seas Protect Plan has no travel insurance coverage but is merely a cancellation penalty policy disguising itself as a Cancel For Any Reason policy. It carries no travel insurance benefits and is extremely expensive.

In contrast, by comparison shopping, we found the AIG Travel Guard Plus policy comes in at $1,134.06, ($1,445 LESS than the Pearl Seas’ Cruise Protection Plan!) It includes $100,000 of medical coverage, $1 million of medical evacuation benefits, 100% refund for trip costs for covered cancellations, a 150% refund for covered trip interruption, and a robust list of cancellation reasons.

Even opting for a Cancel For Any Reason plan through TripProtectors was a better option than the Pearl Seas’ Cruise Protection Plan. The AIG Travel Guard Plus (CFAR 50%) plan is $1,494.40 ($1,085 LESS than the Pearl Seas’ Cruise Protection Plan!) It also includes $100,000 of medical coverage, $1 million of medical evacuation benefits, 100% refund for trip costs for covered cancellations, a 150% refund for covered trip interruption, and a robust list of cancellation reasons. Plus, it includes a Cancel For Any Reason provision that refunds 50% of trip costs back in cash, rather than future credit. It has superior coverage over the Pearl Seas’ Cruise Protection Plan at almost half the cost.

Conclusion

We think that Pearl Seas’ Cruise Protection Plan is an inadequate and very expensive plan for cruisers who may believe they have medical coverage when they don’t.

Luckily, there are less expensive cruise insurance plans with better coverage out there. TripProtectors can help you find them.

Travelers planning a Pearl Seas cruise vacation will find the best value for their money and peace of mind when they shop for travel insurance at TripProtectors Travel Insurance Marketplace. There, you can review dozens of options and select the best policy to fit your needs.

To help you find the best policy, TripProtectors recommends having at least $100,000 in travel medical coverage and $250,000 emergency medical evacuation when traveling outside the US. And, if you purchase the policy within the 14-21 days of initial trip payment, please consider a travel insurance policy with the pre-existing condition waiver included to ensure the most coverage for your money.

If you are planning a Pearl Seas cruise in 2022, be sure to pack insurance before you travel. You never know when you may need it.

Have questions? Chat with us online, send us an email at agent@TripProtectors.com or alternatively call us at +1(650) 397-6592. We would love to hear from you.

Safe Travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

customer

Easy to navigate & user friendly.

Easy to navigate & user friendly.

Marilyn Zibbon

Kendall was very pleasant

Kendall was very pleasant, knowledgeable and personable. He sure knows his stuff! I would recommend AARDY to my family and friends!

Marcia

Easy to use

Easy to use, good for your money! They have it all figured out for you.