Regent Seven Seas Cruises Insurance - 2025 Review

Regent Seven Seas Cruises Insurance

6

Strengths

- Strong Insurance Partner

- Available at Check-Out

Weaknesses

- Weak Medical Coverage

- Weak Medical Evacuation

- Expensive

Sharing is caring!

Regent Seven Seas Cruises is recognized as one of the world’s premier luxury cruise lines. Perfect for active seniors, with their brand promise of Luxury Goes Exploring, Regent Seven Seas travels to more than 510 destinations worldwide. One would think that with all the luxury Regent Seven Seas offers, they would also offer a luxurious travel insurance plan. We found the only thing luxurious in the Regent Seven Seas Cruises travel insurance is the price.

Regent Seven Seas offers one travel insurance plan, their Guest Protection Program. The plan is underwritten by Nationwide, a strong insurance partner, and administered by AON Affinity, another strong insurance partner.

TripProtectors knows that every traveler has different needs, and only by having multiple options can a traveler find a plan that best fits their travel needs. In this review, we’ll compare Regent’s Guest Protection Program to travel insurance plans available on the wider marketplace, so you can determine what option is best for you.

Our Regent Cruise: Riviera Dreaming

For our example, we chose a 16-night cruise from Los Angeles, CA, to Lima, Peru, from 11/3/22-11/19/22, for our sample couple, ages 55 and 60. After taxes and fees, the cruise cost total is $24,998 for both travelers.

Guest Protection Program Cost

To add Regent’s Guest Protection Program to their booking, it would cost our two travelers an additional $4,999.60. That’s 20% of their trip cost, which is an exorbitant premium to pay for the lack of coverage offered. We’ll discuss that further later on, but first, let’s look at what other options are available on the wider travel insurance marketplace.

Alternative Travel Insurance Options

Whenever we review cruise line travel insurance plans, we always compare them to options available on the wider marketplace. This way, you’re able to see what the cruise line offers and whether it’s a good value and fit for your needs.

TripProtectors recommends all travelers venturing abroad have sufficient insurance in case of an overseas catastrophe. This saves you the heartache of paying for medical treatment out of pocket or a possible 6-figure transportation fee to return home in a worst-case scenario.

Therefore, TripProtectors advises carrying a minimum of $100k Medical Insurance, $250k Emergency Medical Evacuation, and a Waiver of Pre-Existing Medical Conditions whenever possible. This is the primary benchmark we use to determine if a cruise lines travel insurance is up to par.

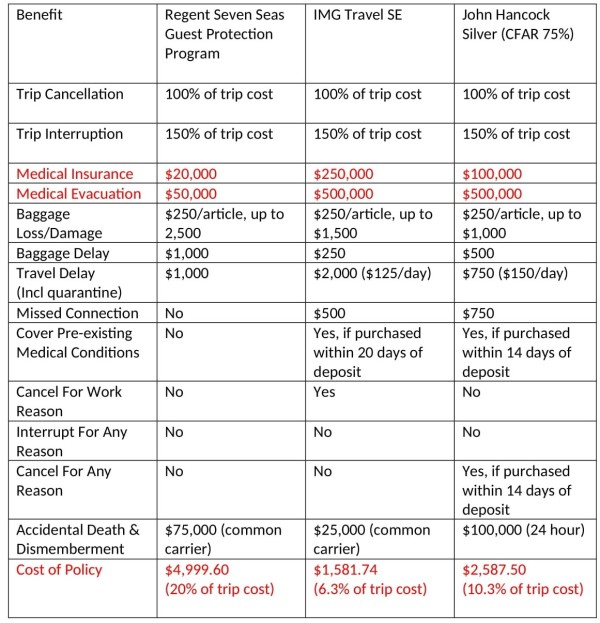

Using the same trip details, we ran a quote at TripProtectors that produced 25 available travel insurance options. For this review, we compared the Guest Protection Program available from Regent to two plans available at TripProtectors.

First, we compared it to the least expensive plan that meets our minimum recommendations for this trip, which is the IMG Travel SE for $1,581.74. This plan offers a savings of $3,417.86 over Regent’s Guest Protection Program.

Then, we compared it to the John Hancock Silver (CFAR 75%) for $2,857.50, because that is the least expensive plan that both meets our minimum recommendations and includes the option to Cancel For Any Reason, which still results in a savings of $2,412.10.

Next, we’ll look at how the our two chosen plans from TripProtectors compare with Regent’s plan in a side-by-side comparison.

As you can see, Regent’s Guest Protection Program offers minimal coverage for the exorbitant premium, especially when it comes to the low Medical Insurance and Medical Evacuation coverage offered. Furthermore, the plan doesn’t cover Pre-Existing Conditions nor offer a Cancel For Any Reason option.

On the other hand, both IMG Travel SE and John Hancock Silver (CFAR 75%) provide adequate Medical Insurance and Medical Evacuation coverage, and have the ability to cover Pre-Existing Conditions. John Hancock Silver (CFAR 75%) also offers the added benefit of allowing a traveler to cancel their trip for any reason whatsoever, and still receive a partial reimbursement of their trip cost.

Now, we’ll discuss these important coverages further.

Trip Cancellation

Travelers value Trip Cancellation benefits because it allows you to get a full reimbursement of your pre-paid and non-refundable trip costs if you must cancel your trip for a covered reason. As such, the more covered reasons a policy has for cancellation, the better.

Disappointingly, the Guest Protection Program only covers a mere 6 cancellation reasons:

1. Your Sickness, Accidental Injury or death, that results in medically imposed restrictions as certified by a Physician at the time of Loss preventing Your participation in the Trip. A Physician must advise to cancel the Trip on or before the Scheduled Departure Date.

2. Sickness, Accidental Injury or death of a Family Member or Traveling Companion booked to travel with You, that results in medically imposed restrictions as certified by a Physician that causes Your Trip to be cancelled.

3. Sickness, Accidental Injury or death of a non-traveling Family Member.

4. You or Your Traveling Companion are a victim of a felonious assault.

5. You or Your Traveling Companion being hijacked, Quarantined, required to serve on a jury, or subpoenaed within ten (10) days of departure; having Your Home made Uninhabitable by Natural Disaster.

6. You or Your Traveling Companion being directly involved in a traffic accident (substantiated by a police report provided by You to the Company) while en route to departure.

With a comprehensive trip insurance program found on the marketplace, travelers enjoy the best possible coverage without paying an unnecessarily high premium. These policies cover all the above reasons and more, including but not limited to:

- Your destination rendered uninhabitable or inaccessible by fire, flood, natural disaster, or vandalism

- A terrorist incident your destination

- A documented theft of passport or visas

- An unannounced strike causing a complete cessation of services

- Inclement weather causing a complete cessation of services

- Equipment failure/mechanical breakdown of the Common Carrier

- Involuntary termination or layoff

- Revocation of military leave due to war

- Bankruptcy or default of airline, cruise line, tour operator

By comparison, the IMG Travel SE covers all the above, with a staggering total of 39 covered cancellation reasons. Another massive benefit of this plan is that it covers cancellation if the US State Department issues a new Level 4 (Do Not Travel) advisory for your destination country after the policy is in effect and within 30 days of departure. Many travel insurance plans do not cover this, and it is especially helpful to have in these times of Covid-19.

While the John Hancock Silver (CFAR 75%) covers 14 cancellation reasons, it also includes Cancel For Any Reason. Cancel For Any Reason allows you to cancel for any other reason not listed in the policy and still receive up to a 75% reimbursement of your trip cost.

We’ll discuss Cancel For Any Reason further below.

Cancel For Any Reason

Cancel For Any Reason coverage offers piece of mind and flexibility by allowing you cancel your trip and receive a partial refund for any reason not otherwise listed in the policy, provided certain conditions are met.

To be eligible for a Cancel For Any Reason plan, you must:

- Purchase a plan within 10-21 days (depending on the policy) of placing your initial payment or deposit towards your trip

- Insure 100% of your pre-paid and non-refundable trip costs

- Cancel your trip no later than 48 hours prior to departure

Cancel For Any Reason reimburses 50%-75% (depending on the policy) of your total trip cost when you cancel your trip for any reason that is not covered under the policy. However, when cancelling for a covered reason, such as an unforeseen illness, you would still be reimbursed 100% of your total trip cost.

John Hancock Silver (CFAR 75%) is available for purchase within 14 days of your initial payment or deposit towards your trip, whereas Regent Seven Seas does not offer Cancel For Any Reason coverage.

Trip Interruption

Similar to Trip Cancellation, Trip Interruption reimburses you for the missed portion of your trip if you experience a covered disruption. For example, if you unexpectedly fell ill during the cruise and had to seek treatment off the ship for two days, that’s a covered Trip Interruption (along with a Medical Insurance claim).

In some cases, if time allows, your Trip Interruption may allow you to return to the trip after missing a portion of it. Other times, you might have to go home early to tend to a family emergency.

Trip Interruption reimburses you up to your insured trip cost for the unused, prepaid non-refundable expenses for your land/water travel arrangements, plus the additional transportation cost paid to either:

- Join your trip if you must depart after your scheduled departure date or travel via alternate travel; or

- Rejoin your trip from the point where you interrupted your trip or transport you to your originally scheduled return destination.

The three plans we reviewed in this article all cover up to 150% refund. The extra 50% helps cover the added cost of transportation. Trip Interruption insurance that exceeds 100% is a hallmark of a robust and comprehensive travel insurance policy, so we’re happy to see Regent’s Guest Protection Program offer this coverage as well.

Medical Insurance

Medical Insurance is one of the most critical elements of a travel insurance plan.

Americans often have the false impression that countries with universal health care will treat them for free, but this is not the case. Citizens pay taxes for this privilege, whereas travelers would be required to pay full cost for health care. Inpatient care at a private hospital can run $3,000 to $4,000 per night, plus treatments and surgeries.

Even more troublesome, Medicare does not pay for your treatment outside the US. In addition, many private healthcare plans only reimburse for emergencies. For example, although some Medicare supplements cover up to $50k of emergency treatment abroad, that’s a lifetime limit and you’ll be on the hook for a 20% co-pay out of pocket. These policies falsely lead you to believe you’re safely covered but leave your retirement savings exposed to the risk of sudden, catastrophic financial loss.

Furthermore, the US State Department does not provide any medical support to Americans traveling overseas. In fact, the US State Department and CDC emphatically recommend all travelers get robust Medical Insurance.

Thus, TripProtectors advises travelers carry at least $100k in Medical Insurance when leaving the US. This is enough coverage to assure you’re properly treated without paying off medical bills for years to come.

Disappointingly, Regent’s Guest Protection Program only offers $20k in Medical Insurance. Meanwhile, the IMG Travel SE covers $250k in Medical Insurance and the John Hancock Silver (CFAR 75%) covers $100k. These levels are much better suited for international travel.

Emergency Medical Evacuation

Medical Evacuation coverage pays for transportation from the place of injury or illness to a local hospital. Once you’re stable and the physician treating you determines it’s necessary, Medical Evacuation returns you home. In a worst-case scenario, such as if your condition is critical and you require ongoing care by a medical team to return home, an air ambulance might be most appropriate.

Private air transportation such as this can cost $15k to $25k per flight hour and coming back to the US from overseas can get very expensive, very quickly.

In addition, many travelers assume their private health insurance pays for Medical Evacuation so they can get home. In fact, private health insurance plans, including Medicare supplements, do not include Medical Evacuation benefits beyond a limited amount for a ground ambulance to the hospital. So, that medical flight cost comes out of your pocket and leaves your retirement savings at risk.

For these reasons, TripProtectors recommends all travelers leaving the US carry a minimum of $250k Emergency Medical Evacuation coverage. Travers venturing even further away from home, to destinations such as Africa, Asia, or beyond, should carry a minimum of $500k.

Regent’s Guest Protection Program offers a meager $50k Medical Evacuation benefit. This is simply not enough coverage to ensure you’re properly protected for a worst-case scenario. Alternatively, both IMG Travel SE and John Hancock Silver (CFAR 75%) cover $500k per person.

Pre-Existing Medical Conditions

A Pre-Existing Condition refers to an injury, illness, or disease of an insured, traveling companion, business partner, or family member, for which care, testing or treatment was given or recommended by a physician, within the 60-180-day period immediately preceding, and including, the purchase date of the plan.

Travel insurance does not pay benefits for Pre-Existing Conditions. It’s a standard, industry-wide exclusion. However, many policies offer a waiver that adds coverage for Pre-Existing Conditions back into the policy. Typically, these policies must be purchased within 14-21 days (depending on policy) of the date you place your initial payment or deposit towards the trip. This timeframe is called the Time Sensitive Period.

TripProtectors recommends travelers, especially seniors, purchase a travel insurance plan that covers Pre-Existing Conditions whenever possible.

Regent’s Guest Protection Program does not offer a Waiver of Pre-Existing Conditions, but will automatically cover your condition if it is stable, older than 60 days, and controlled with medication.

Alternatively, both IMG Travel SE and John Hancock Silver (CFAR 75%) include a Waiver of Pre-Existing Conditions if purchased within the Time Sensitive Period. The Time Sensitive Period is 20 days for IMG Travel SE and 14 days for John Hancock Silver (CFAR 75%).

There is no additional fee for the waiver, it’s just a matter of timing. If you wait too long to buy travel insurance, you lose out on the peace of mind that comes with the Pre-Existing Condition Waiver.

However, like the Guest Protection Program, both policies will still automatically cover your Pre-Existing Condition if the condition is stable, older than 60 days, and controlled with medication, even if you purchase outside of the Time Sensitive Period.

Conclusion

Regent’s Guest Protection Program offers insufficient coverage for the high price. In fact, cruisers, particularly seniors, who purchase the policy believing they’ll have proper cancellation protection and medical benefits would be in for a harsh reality if they had to make a claim.

Here’s why:

- Medical Insurance and Medical Evacuation limits are incredibly low. It leaves the traveler open to a massive financial risk in the event of a medical emergency.

- Trip Cancellation and Trip Interruption coverages are extremely limited.

- Pre-Existing Medical Conditions are excluded with Regent.

- The plan does not even cover default of Regent Seven Seas itself - the cruise line. If Regent went into bankruptcy, neither their travel insurance plan nor the company itself would pay for a reimbursement.

All in all, it’s a traveler-unfriendly and restrictive policy with a premium price. You can find a much better value for your money by comparing travel insurance plans available at TripProtectors and potentially save thousands of dollars. In our review, we found that our sample couple would save an astounding $3,417.86 by selecting the IMG Travel SE over Regent’s Guest Protection Program.

Even selecting a more flexible Cancel For Any Reason plan like the John Hancock Silver (CFAR 75%) would save our sample couple $2,412.10. Either option would result in a huge savings over the Guest Protection Plan and ensure you’d have adequate protection for your trip. The savings you’d receive could instead be used towards expenses on your trip, such as dining, shopping, tours – or even a new trip entirely! Overall, we rate Regent’s insurance a 6 out of 10.

Will I Save by Purchasing Directly Through the Insurer?

No, all travel insurance premium rates are filed in each state and the prices cannot be lower or higher than those filed. So, TripProtectors can guarantee you will not find lower rates for the products offered on our website.

Have questions? We would love to hear from you. Send us a chat, email, or call us at +1(650) 397-6592.

Safe Travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

Jocelyn

No stress travel

Very nice and knowledgeable

Orlando - paid customer

Getting travel insurance through the…

Getting travel insurance through the AARDY website was simple and easy. It took us several failed attempts and representative calls over a 5-day period on other sites. On AARDY, we were done and all paid up in 10 minutes. Excellent.

Yvonne Virginia Overcast

easily understood

easily understood