Swiss Airlines Travel Insurance - 2025 Review

Swiss Airlines Travel Insurance

10

Strengths

- Travel Insurance Cover is Not Offered

- Customers free to choose best insurance option from market

Weaknesses

- No advice is offered to purchase travel insurance

Sharing is caring!

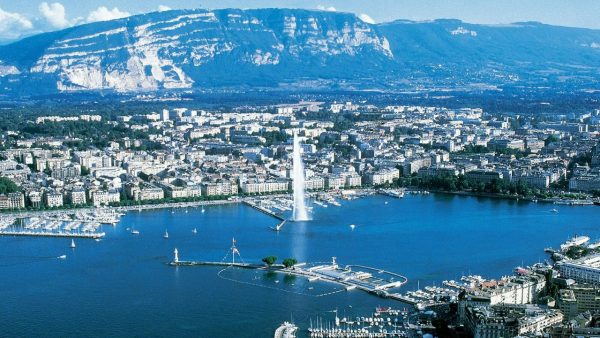

Swiss International Air Lines AG, colloquially known as SWISS, is the flag carrier of Switzerland, operating scheduled services in Europe and to North America, South America, Africa, and Asia.

Travel insurance is not offered at checkout when booking flights with Swiss Air. This is good news! Travelers are free to shop the open marketplace for the best travel insurance for their needs.

Let’s book a sample flight and then shop the open marketplace for insurance.

Our Sample Trip – New York to Zurich

For our sample trip, our two travelers are traveling from JFK to Zurich from December 13 - December 31. We were given the option of choosing the type of fare we want – Economy, Business, or First Class when we were inputting our trip details. We chose Economy for our trip and a grid is displayed with the Economy options for the departure date chosen. Economy fares start at $548.50, while Premium Economy starts at $963.50.

Selecting ‘Economy’ from our two choices, brings up an addition selection of the various Economy fares:

Economy Light is the least expensive and a bare-bones fare with a carry-on allowed but no checked baggage. Rebooking and refunds are also not available for this fare. Economy Basic does allow one checked bag as well as a carry-on and will allow rebooking with a penalty but does not allow refunds.

Economy Flex, the most expensive of the Economy fares is similar to the Economy Basic but will allow a refund without a penalty.

After reviewing our options, we stuck with the least expensive option – Economy Light for $548.50 per traveler.

Next, we had the option of choosing our seats and adding a checked bag (for a fee) before proceeding to checkout and purchase. Total final cost for both travelers is $1,332.88

Now that we have our flights booked and travel insurance is not available at checkout on the Swiss Air site, let’s shop for travel insurance in the open marketplace through TripProtectors.

TripProtectors – The Travel Insurance Marketplace

TripProtectors is a travel insurance marketplace. We work with some of the largest trip insurance carriers in the country. We provide your travel details to them, and they provide binding quotes back which we sort in price order then highlight a plan we recommend for your trip. You don’t have to waste time shopping for quotes from individual companies.

Using TripProtectors’s quoting tool and inputting our trip details, we are presented with 21 policies to choose from.

For international travel, TripProtectors recommends having at least $100,000 in medical coverage and $250,000 in medical evacuation coverage. A waiver of pre-existing medical conditions is also recommended if needed.

The least expensive plan for our trip with adequate medical coverage is the Travel Insured Worldwide Trip Protector at $114.00, which is the total cost for both travelers combined.

This policy provides $100,000 of medical coverage and $1 million of medical evacuation coverage as well as a waiver for pre-existing medical conditions if the policy is purchased within 21 days of the initial trip payment or deposit date.

If we need to cancel for a reason listed in the policy, such as illness or injury, we’ll receive a 100% refund of our non-refundable trip costs.

What if we want maximum flexibility to cancel for any reason NOT listed in the policy? What options do we have? The answer is a Cancel For Any Reason (CFAR) policy.

Cancel For Any Reason (CFAR) Policies

Cancel for Any Reason (CFAR) policies give us maximum cancellation flexibility by allowing us to cancel for any reason NOT listed in the policy and still receive a partial refund of our trip costs.

This is a super-powerful benefit that does exactly what it says. A traveler needs to have no reason at all to cancel and still receive a significant refund.

The least expensive CFAR policy on our list is the Travel Insured Worldwide Trip Protector Plus (CFAR 75%) for $172.00.

The policy provides $100,000 of medical coverage and $1 million of medical evacuation coverage as well as a waiver for pre-existing medical conditions AND the addition of Cancel For Any Reason benefits if the policy is purchased within 21 days of the initial trip payment or deposit date.

If we cancel for a reason listed in the policy we’ll receive a 100% refund of our trip costs, but if we cancel for a non-listed reason, we’ll receive a 75% refund of the trip costs.

Cancel For Any Reason policies are excellent options instead of spending extra money purchasing a refundable airline ticket – and often less expensive! The use of Cancel for Any Reason insurance to lower ticket prices has been described as the Airline Ticket Hack. Refundable benefits, yet with Non-Refundable ticket costs.

Aardy – One Site – Many Carriers

Our job at TripProtectors is remarkably simple. We are like Amazon for travel insurance. We compare the trip insurance policies from some of the largest travel insurers in the USA.

Your travel information is sent to each of them, anonymously. You will get travel insurance quotes from each carrier and can compare them to see which is the best policy for you.

Does TripProtectors charge More?

You cannot find the same trip insurance plans available at a better price. In the USA this price guarantee comes from strong anti-discriminatory insurance regulation. We cover this in detail in our article - Travel Insurance Comparison.

A travel insurance marketplace like TripProtectors will offer a multitude of different plans from some of the most respected travel insurance carriers in the country. You will only need a few minutes to check value for money, cover, and insurance carrier ratings.

Enjoy your next trip with Swiss Airlines and don’t forget to pack your travel insurance.

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

customer

The ability to compare the various plans and the customer friendly site,

The ability to compare the various plans and

customer

The experience has been very positive

The experience has been very positive. Thank you for your inquiry.

Jamie

Miranda

Your phone agent , Miranda, was very personable, knowledgeable, helpful, and efficient.