Trawick Safe Travels Travel Insurance - 2025 Review

Trawick Safe Travels Travel Insurance Company Overview

8

Strengths

- Trawick Safe Travels Travel Insurance Company Overview

Weaknesses

- No Weaknesses

Sharing is caring!

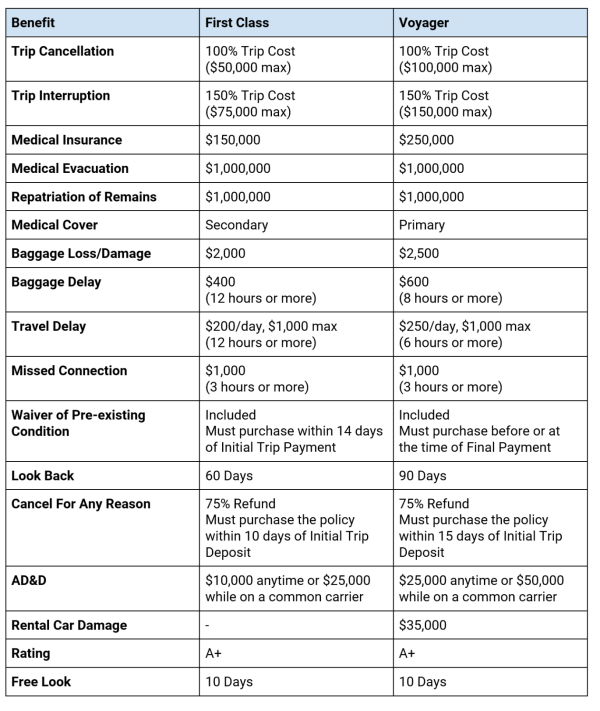

Trawick Travel Insurance is a partner of TripProtectors. We showcase their First Class and Voyager Travel Insurance Products. Note the strong Emergency Medical, Medical Evacuation, and Pre-Existing Medical Condition Exclusion Waiver benefits in these policies.

We find Trawick Travel Insurance plans to be highly robust, and certainly worthy of consideration in any travel insurance comparison.

We always advise that travelers carry at least $100,000 of Emergency Medical Insurance when traveling overseas. Our recommendation provides reasonable coverage if severe illness or injury occurs, followed by a prolonged period of treatment.

No one enjoys thinking about these things, but US travelers experience accidents every day overseas. We believe it's best to have suitable levels of coverage in place because it provides peace of mind. The Trawick First Class and Voyager Travel Insurance policies exceed our recommendations.

Also, we encourage all travelers to consider a trip insurance policy with a Medical Waiver. Medical Waivers allow the plan to cover Pre-existing Medical Conditions. Without a Waiver, travel insurance excludes Pre-existing Conditions.

When a travel insurance plan offers a Waiver of Pre-existing Conditions, it embeds the Waiver in the policy. There is no additional cost to the insured. The Waiver is automatically included when you buy travel insurance within the required time sensitive period.

Trawick International is a full-service travel insurance provider specializing in travel-related coverage for tourists, students, scholars, businesses, groups, and all other globe trekkers.

Trawick Travel Insurance is underwritten by Nationwide Mutual Insurance Company and administered by Co-ordinated Benefit Plans.

Travel Insurance provides emergency assistance services if you have a problem during your trip. Travel Insurance covers the unexpected costs such as having to cancel or interrupt your trip due to unforeseen reasons, such as the illness of you, a family member, or a travel companion, severe weather, missed connections, strikes, default of travel supplier and other unexpected events that may arise before or during your trip. Plans include trip cancellation and trip interruption, accident and sickness with assistance services, medical repatriation, baggage coverage, accident insurance, travel accident insurance, and many other benefits.

This insurance also includes toll-free, 24/7 multilingual emergency assistance services to help arrange any care you may need while you are away from home.

Let's take a look at the Trawick Trip Insurance plans.

Trawick Travel Insurance - First Class

Trawick First Class Travel Insurance plan is their mid-range policy, but don't let that fool you. This trip insurance plan is still loaded with great benefits and services.

The First Class Travel Insurance plan is for travelers seeking to protect their trip investment against trip cancellation and trip interruption. It is well suited for both domestic and international travel and provides the option for Cancel For Any Reason. Also, First Class includes coverage for travel and baggage delay as well as emergency travel assistance service.

Trawick First Class Travel Insurance Benefits

Maximum Limits Per Person

Trip Cancellation - 100% of Trip Cost Up to $50,000*

Trip Interruption - 150% of Trip Cost up to $75,000**

Travel Delay - $1,000 ($200 per day after an initial delay of 12 hours or more)

Missed Connection - $1,000 (after an initial common carrier delay of 3 hours)

Airline Exchange Fee - $100

Rebanking of Miles or Reward Points - $200

Baggage & Personal Effects - $2,000

Baggage Delay - $400 (after an initial delay of 12 hours)

Accident & Sickness Medical Expense - $150,000

Emergency Medical Evacuation - $1,000,000

Accidental Death & Dismemberment - $10,000 anytime; $25,000 common carrier

Pre-existing Condition Waiver Available - if purchased within 14 days of your Initial Trip Deposit

Medical Coverage Type - Secondary

Trawick Travel Insurance - First Class - Covered Perils

Emergency Sickness/Illness/Injury/Death - Yes

Hijacking, Medical Quarantine, Subpoena or Jury Duty - Yes

Home uninhabitable due to fire, flood, burglary or Natural Disaster - Yes

Direct involvement in a documented traffic accident while en route to your departure - Yes

Organized Labor Strike - Yes

Terrorist Incident - Yes

Inclement Weather and Natural Disaster - Yes

Revocation of previously granted military leave - Yes

Financial Default of Travel Supplier - Yes

Theft of passport or visa that prevents departure - Yes

Mandatory evacuation ordered by government authority due to adverse weather and Natural Disaster - Yes

Trawick Travel Insurance - First Class - Additional Information

Maximum Trip Duration - 90 days

Maximum Traveler Age - 79

Pre-Existing Condition Review Period - 60 days

Premium Refunds - You may submit a cancellation request and receive a full refund within 10 days from the effective date of your coverage***

Latest date plan can be purchased - 1 day before departure

24/7 Emergency Travel Assistance - Included

This is only a summary of the Trawick First Class program. Please read the policy carefully to fully understand the coverages, terms, conditions, limits, and exclusions. Not all plans or coverages are available in every state. This summary does not replace or change any part of your policy. If there is a conflict between this summary and the policy, the policy will control.

The amount of benefits provided depends upon the plan selected. Premium is based on the traveler's age and the trip cost. Rates are subject to change at any time.

You can purchase the plan at any time, but you are only eligible for Cancel For Any Reason if you purchase it within 15 days of the Initial Trip Deposit. Other benefits will apply as per the terms and conditions of the policy.

*The trip cancellation benefit is determined by the amount of your trip you elect to protect, up to the maximum benefit stated above.

**The trip interruption benefit is determined by the amount of trip cancellation benefit purchased. All benefits are per insured person.

Trawick Voyager Travel Insurance Benefits

Maximum Limits Per Person

Trip Cancellation - 100% of Trip Cost* up to $100,000 Trip Cost

Trip Interruption - 150% of Trip Cost** up to $150,000 Trip Cost

Travel Delay - $1,000 ($250 per day after an initial delay of 6 hours or more)

Missed Connection - $1,000 (after an initial common carrier delay of 3-6 hours)

Airline Reissue or Cancellation Fee - $100

Reimbursement of Miles or Reward Points - Up to maximum shown on the schedule of benefits

Baggage & Personal Effects - $2,500 ($300 per article)

Baggage Delay - $600 (after an initial delay of 8 hours)

Accident & Sickness Medical Expense - $250,000

Emergency Medical Evacuation - $1,000,000

Accidental Death & Dismemberment - $25,000 anytime; $50,000 common carrier

Pre-existing Condition Waiver Available - if purchased before or on your Final Payment due date

Medical Coverage Type - Primary

Trawick Travel Insurance - Voyager - Covered Perils

Emergency Sickness/Illness/Injury/Death - Yes

Hijacking, Medical Quarantine, Subpoena or Jury Duty - Yes

Home uninhabitable due to fire, flood, burglary or Natural Disaster - Yes

Direct involvement in a documented traffic accident while en route to your departure - Yes

Organized Labor Strike - Yes

Terrorist Incident - Yes

Inclement Weather and Natural Disaster - Yes

Revocation of previously granted military leave - Yes

Financial Default of Travel Supplier - Yes

Theft of passport or visa that prevents departure - Yes

Mandatory evacuation ordered by government authority due to adverse weather and Natural Disaster - Yes

Trawick Travel Insurance - Voyager - Additional Information

Maximum Trip Duration - 180 days

Pre-Existing Condition Review Period - 90 days

Premium Refunds - You may submit a cancellation request and receive a full refund within 10 days from the effective date of your coverage***

Latest date plan can be purchased - 1 day before departure

24/7 Emergency Travel Assistance - Included

This is only a summary of the Trawick Voyager program. Please read the policy carefully to fully understand the coverages, terms, conditions, limits, and exclusions. Not all plans or coverages are available in every state. This summary does not replace or change any part of your policy. If there is a conflict between this summary and the policy, the policy will control.

The amount of benefits provided depends upon the plan selected. Premium is based on the traveler's age and the trip cost. Rates are subject to change at any time.

You can purchase the plan at any time, but you are only eligible for Cancel For Any Reason if you purchase it within 15 days of the Initial Trip Deposit. Other benefits will apply as per the terms and conditions of the policy.

*The trip cancellation benefit is determined by the amount of your trip you elect to protect, up to the maximum benefit stated above.

**The trip interruption benefit is determined by the amount of trip cancellation benefit purchased. All benefits are per insured person.

Trawick FAQ

What if I buy it and decide the coverage isn't right for me?

If you are not completely satisfied with the travel insurance you have purchased, you can call to cancel within 10 days of the effective date. Trawick Travel Insurance will cancel the policy and refund your premium as long as you have not yet departed on your trip, nor submitted a claim.

This refund policy is known as the Free-Look Period. Free-Look may not be available in some states.

If I already have medical coverage, why do I need to pay for it again within travel insurance coverage?

Travel Medical Expense is designed to cover expenses for accidental injury and sickness occurring on your trip. This benefit provides coverage for medically necessary care that may not be covered on your health insurance plan.

You should check with your health insurance provider to verify if you are covered outside of the plan area or the US. This travel insurance also includes valuable 24/7 emergency assistance to aid with locating medical care, medically necessary transportation, and arranging payment for medically necessary care.

If your trip is extended on the order of a physician due to an illness or accidental injury incurred while traveling, the policy may cover hotel and meal expenses, as well as additional airline transportation costs.

Travel assistance services can also help you with many other tasks, such as arranging for forgotten or damaged prescription medication, locating an English-speaking doctor, and ensuring you are receiving the right care for a medical emergency.

The multilingual assistance staff provide you with helpful information and advise you where to go if you lose your passport, need cash or legal services at your destination

What is a Pre-existing Condition?

Pre-existing medical condition means any accidental injury, sickness, or disease of you, your traveling companion, or your family member booked to travel with you for which medical advice, diagnosis, care, or treatment was recommended or received within 60 days ending on the effective date.

Illnesses or conditions are not considered pre-existing if the sickness or disease for which prescribed drugs or medicine is taken remains controlled without any change in the required prescription throughout the entire 60-day period ending on the effective date, and no medical advice, diagnosis, care or treatment has otherwise been received.

What is a covered Trip?

Trip means scheduled to travel with a defined itinerary away from your home for which coverage is purchased under this policy, and the premium is paid.

What events are covered under Trip Interruption?

Typically, an insured can interrupt their trip for the same or similar reasons as they can for canceling their trip. Trip Interruption differs because it provides coverage once you depart for your covered trip.

The insured will be reimbursed for prepaid, unused, and non-refundable travel arrangements plus additional transportation costs to catch up to their trip or return home early.

Under what conditions can I cancel my travel insurance policy?

All premium is refundable only during the ten (10) day review period from the

date of purchase (or from the date of receipt if mailed) provided you have not already departed on your trip, and you have not incurred any claimable losses during that time. If you depart on your trip prior to the expiration of the review period, the review period shall automatically end upon your departure.

Can I buy travel insurance after an incident has occurred?

Travel insurance coverage applies only to unforeseen issues that occur after the policy is in effect. Insurance does not cover events that are no longer unexpected or unforeseen.

What is considered an Accident?

An accident is defined as a sudden, unexpected, unusual, specific event that occurs at an identifiable time and place during the covered trip and also includes a mishap to a conveyance in which you are traveling.

Are there any coverage exclusions?

The complete details of coverage exclusions that may affect coverage and benefits payable are summarized in the certificate. Please read the certificate carefully and note all exclusions and state exceptions that may apply.

How can a traveler get assistance while on a trip?

For 24/7 Travel Assistance Services Only

Call Toll-free: 855-464-8974 (Within the United States and Canada)

Or Call Collect: 603-328-1361 (From all other locations)

When does insurance coverage begin?

Provided:

a) coverage has been elected; and

b) the required premium has been paid.

All coverage except trip cancellation and optional trip cancellation for any reason will begin on the scheduled departure date, or the actual departure date if a change is required by a common carrier when you depart for the first travel arrangement (or alternate travel arrangement if you must use an alternate travel arrangement to reach your trip destination) for your trip. Coverage will not begin before the effective date shown on your purchase confirmation.

Trip cancellation and optional trip cancellation for any reason coverage will begin on your effective date. No coverage can be purchased after a person departs on a trip.

What is AD&D – Air only?

The company will pay benefits for accidental injuries resulting in a loss as described in the table of losses below, that occurs while you are riding as a passenger in or on, boarding or alighting from, any air conveyance operated under a license for the transportation of passengers for hire during the trip. The loss must occur within one hundred eighty (180) days after the date of the accident causing the loss. The principal sum is shown on the schedule of benefits.

Complete details of coverage terms, limitations, and exclusions that may affect benefits payable are summarized in the certificate. Please read the certificate carefully and all state exceptions that may apply.

How do I claim with Trawick?

Written notice of claim must be given by the claimant (either You or someone acting for You) to the company or its designated representative within seven (7) days after a covered Loss first begins.

Notice should include Your name and the Plan number. Notice should be sent to the company's administrative office, at the address shown on the cover page of the policy, or to the company's designated representative.

You can download claim forms on Trawick's website: https://www.trawickinternational.com/claim-information/claim-forms

For Claim Status, please contact 866-669-9004 or use the Claims Portal.

Email: GBGClaims@cbpinsure.com

Mail claim form and all necessary documents to:

Co-ordinated Benefit Plans LLC on Behalf of Global Benefits Group

PO Box 2069

Fairhope AL 36533

I Already Have Coverage, Or Do I?

Have you checked out your credit cards lately? Do you know if any of them include travel insurance coverage? Does your healthcare coverage provide benefits outside of the US or even your home state? Maybe your homeowner's plan? Medicare?

Travel insurance provides coverage where none exists and can fill in gaps that exist in other types of insurance. Coverage gaps include a complete absence of coverage, deductibles, exclusions, coinsurance or co-payment penalties. It's always a good idea to review your credit card, health, homeowners, and other insurance programs that you already own, and use the information to help you decide about purchasing travel insurance.

Credit Cards – The average American has four credit cards according to recent estimates. And fewer than 15% provide any travel insurance coverage as a credit card benefit. If they did give any, it was on a minimal basis. Trip cancellation and interruption are not usually provided in any credit card program.

Homeowners or Renters Insurance – Personal Property Coverage in a Homeowner's insurance policy typically provides for loss to your personal property, anywhere in the world. This coverage is subject to named perils (i.e., fire, theft, vandalism, etc.), less a deductible (usually $500 or $1,000), contained in "temporary living quarters" occupied by the named Insured. Your homeowner's insurance will not provide cover for trip cancellation, interruption, baggage delay, or medical benefits.

Health/Medical Insurance Plans – Many domestic health insurance plans will not provide coverage outside the US If they do, the plans may have high deductibles ($1,000 to $5,000) and co-pays (60-80% of eligible charges). Due to the high cost of emergency medical transportation, the coverage will not be offered through traditional health insurance.

Medicare – To qualify for Medicare, a US citizen must be aged 65 or older. Medicare does not provide coverage outside the US unless a Medigap (C or higher) plan is purchased. Medigap plans generally limit coverage to 80% of emergency treatment costs less a $250 deductible. Many Medigap plans also have a lifetime maximum of $50,000.

US Embassies – The US government does not provide coverage for medical costs or medical transportation needs. The State Department may assist in arranging medical transportation, but you are responsible for payment.

It is wise to check your other insurance carefully and understand what benefits are offered with your credit card and how those benefits are activated. The airlines, cruise lines, hotels, and tour operators have cancellation penalties. Having a discussion with your travel agent will help you become aware of your financial exposure should the unexpected happen.

As always, we recommend that a traveler consider whether to buy travel insurance. At TripProtectors, you can get a quick, anonymous quote and compare dozens of the top travel insurance plans from many of the largest US travel insurers, saving you time and money finding the right travel plan for your travel needs.

Did you know that they won't find the same trip insurance plans available at a better price? That's because of price certainty anti-discriminatory law in the US.

Travel Insurance Comparison – Will I Pay More Buying Travel Insurance from a Comparison Website?

The price of a trip insurance quote for an insurance plan that you see on TripProtectors is the same price you would see from the insurance carrier direct – we are not allowed to compete on price for 'filed' insurance products. No one is.

You'll always find the lowest possible price and value right here at TripProtectors.

Visit TripProtectors first to see your options before committing to the first travel insurance policy you're offered. Stop by and have a chat, send an email, or give us a call at +1(786) 751-2984 .

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

Pam S.

Easy to use

The website is very easy to use. I was very happy to have access to the AARP discount as well.

Carla Lehn

Amanda was very clear and helpful.

Amanda was very clear and helpful.

Jocelyn

No stress travel

Very nice and knowledgeable