UnCruise Adventures Travel Insurance - 2025 Review

UnCruise Adventures Travel Insurance Review

7

Strengths

- Reputable Insurance Carrier

- Good Medical Evacuation Coverage

- Pre-existing Medical Condition Waiver

Weaknesses

- Low Medical Insurance Coverage

- Lack of Cancel For Any Reason Option

- Expensive Insurance Premium for Seniors (70+)

Sharing is caring!

Background

UnCruise Adventures began cruising in Alaska in 1996 with only one ship. Over 20 years later, they now offer cruises to some of the world’s most scenic destinations aboard nine cruise ships.

UnCruise’s mission is to provide their guests with an enriching adventure and inspire an appreciation of different cultures and the world. They emphasize in an in-depth interaction with nature. From kayaking in Alaskan harbors to up-close encounters with tortoises in the Galapagos Islands, UnCruise leads their guests to some of the photogenic destinations on earth.

For travel insurance, UnCruise offers a single take-it or leave-it option, their Travel Protection Plan. The plan is underwritten by Berkshire Hathaway Specialty, administered by Travelex Insurance Services, and was created specifically for UnCruise Adventures’ guests.

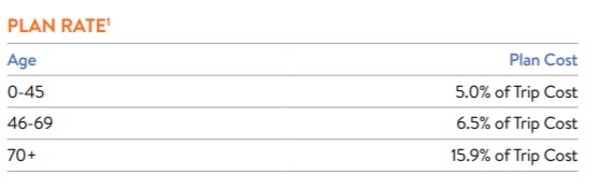

The cost of the Travel Protection Plan is a percentage of your trip cost, however, this percentage is based on age:

In this review, we investigate the travel insurance plan offered by UnCruise Adventures and compare it to third-party plans available on the wider marketplace, so you can make an informed decision on how to get the best value for your money.

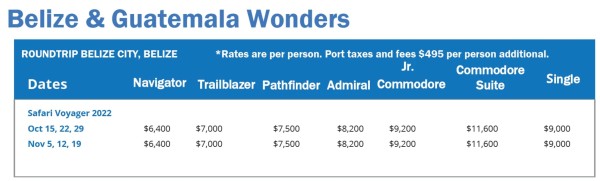

Our Cruise: Belize & Guatemala Wonders

For our example, we chose Belize & Guatemala Wonders for our sample couple, ages 55 and 60. The cruise sails from 10/15/22-10/22/22 and costs $6,400 per traveler when selecting the Navigator option. After taxes and fees, the total cost of the cruise comes out to $13,790 for both travelers. Adding the UnCruise Travel Protection Plan to their booking would cost an additional $896.35.

Next, we’ll compare UnCruise Adventures travel insurance plan with alternative insurance options.

Comparison Quotes

Carrying sufficient insurance when traveling overseas protects you from the possibility of paying for emergency medical treatment out-of-pocket or even incurring a 6-figure transportation fee to be medically evacuated home in the case of an overseas catastrophe.

Therefore, TripProtectors consistently recommends that all travelers heading overseas obtain a policy with minimum of $100k Medical Insurance, $250k Emergency Medical Evacuation, and a Waiver of Pre-Existing Medical Conditions whenever possible. This is the primary benchmark we use to determine if a cruise line’s travel insurance plan is up to par. Travel insurance policies that meet the minimum limits listed above provide substantial coverage for most medical emergencies.

Now, let’s look at three travel insurance plans available at TripProtectors.

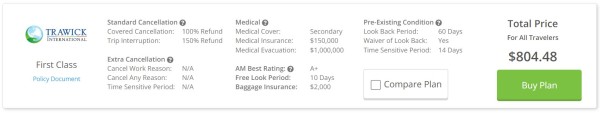

First, we selected Trawick First Class for $804.48, because it is the least expensive plan that meets our minimum recommendations.

Next, we chose IMG Travel SE for $846, to highlight another inexpensive option that meets our minimum recommendations and provides excellent coverage.

Lastly, we looked at Trawick First Class (CFAR 75%) for $1,367.62, because it is the least expensive plan with our minimum recommendations that also includes Cancel For Any Reason coverage. On occasion, travelers require maximum flexibility from an insurance plan. In those situations, a policy that provides Cancel For Any Reason will be most suitable.

Let’s examine how these plans compare, side-by-side.

|

Benefit |

UnCruise Adventures Travel Protection |

Trawick First Class |

IMG Travel SE |

Trawick First Class (CFAR 75%) |

|

Trip Cancellation |

100% of trip cost |

100% of trip cost |

100% of trip cost |

100% of trip cost |

|

Trip Interruption |

150% of trip cost |

150% of trip cost |

150% of trip cost |

150% of trip cost |

|

Medical Insurance |

$30,000 |

$150,000 |

$250,000 |

$150,000 |

|

Medical Evacuation |

$500,000 |

$1,000,000 |

$500,000 |

$1,000,000 |

|

Baggage Loss/Damage |

$1,000 |

$500/article, up to $2,000 |

$250/article, up to $1,000 |

$500/article, up to $2,000 |

|

Baggage Delay |

$500 |

$400 |

$250 |

$400 |

|

Travel Delay (Incl quarantine) |

$500 ($150/day) |

$1,000 |

$2,000 ($125/day) |

$1,000 |

|

Missed Connection |

$750 |

$1,000 |

$500 |

$1,000 |

|

Cover Pre-existing Medical Conditions |

Yes, if purchased within 21 days of deposit |

Yes, if purchased within 14 days of deposit |

Yes, if purchased within 20 days of deposit |

Yes, if purchased within 14 days of deposit |

|

Cancel For Work Reason |

Yes |

No |

Yes |

No |

|

Interrupt For Any Reason |

No |

No |

No |

No |

|

Cancel For Any Reason

|

No |

No |

No |

Yes, if purchased within 10 days of deposit |

|

Accidental Death & Dismemberment |

$10,000 (air only) |

$10,000 (24 hour) |

$25,000 (common carrier) |

$10,000 (24 hour) |

|

Cost of Policy |

$896.35 |

$804.48 |

$846

|

$1,367.62 |

You’ll notice the UnCruise Travel Protection Plan covers $500k for a Medical Evacuation and covers Pre-Existing Conditions if purchased within 21 days of your deposit. We’re delighted to this, as these are areas where many cruise line travel insurance plans lack.

However, the UnCruise plan does still lack in some areas. The first one being Medical Insurance. $30k is simply not enough coverage to be protected for travel abroad. Secondly, their plan does not offer a Cancel For Any Reason option, which is something many travelers desire, especially to cover concerns over Covid-19.

Alternatively, Trawick First Class covers $150k in Medical Insurance, $1m in Medical Evacuation, and includes coverage for Pre-Existing Conditions if purchased within 14 days of your deposit, for $91.87 less than the UnCruise plan.

You’d find another potential savings option with the IMG Travel SE. For $50.35 less than the UnCruise plan, you’d be properly protected with $250k Medical Insurance, $500k Medical Evacuation, and coverage for Pre-Existing Conditions if purchased within 20 days of your deposit.

While the Trawick First Class (CFAR 75%) does cost significantly more than the UnCruise Travel Protection Plan, it offers the added benefit of allowing you to cancel for any other reason not covered by the policy and still receive a significant reimbursement of your trip cost.

We’ll review these critical coverages further below.

Trip Cancellation

Unfortunately, sometimes situations arise that force you to cancel a trip. When life gets in the way of your vacation, Trip Cancellation reimburses you for the full cost of the trip if you cancel for a covered reason.

The UnCruise Travel Protection Plan provides a wide range of cancellation reasons, some of which are listed below, that are similar to the reasons listed in policies available at TripProtectors:

- Unforeseen injury, illness, or death of traveler, traveling companion, or non-traveling family member

- Residence uninhabitable by natural disaster, vandalism, or burglary

- Destination uninhabitable or unreachable due to natural disaster

- Revocation of previously granted military leave

- Subpoena or being called to serve jury duty

- Hurricanes

- Documented theft of passports or visas

- Employer-initiated transfer of 250 miles or more

- Equipment failure/mechanical breakdown of a common carrier

- Default or bankruptcy of the common carrier or travel supplier

- Being hijacked or quarantined

- Terrorism

- Strikes

UnCruise’s plan provides a robust and comprehensive list of cancellation reasons and reimburses 100% of your trip cost when cancelling for any of these situations. We are quite pleased to see this substantial coverage in such a critical area, as most cruise line insurance plans are incredibly restrictive.

Similarly, Trawick First Class and IMG Travel SE cover the reasons listed above and more. In fact, the IMG Travel SE in particular covers over 30 reasons for cancellation.

Trawick First Class (CFAR 75%) takes it one step further. In addition to the covered reasons for cancellation, the plan also offers the added benefit of allowing you to cancel your trip for any reason that’s not otherwise covered by the policy, and still receive a significant reimbursement of your trip cost.

Cancel For Any Reason

Cancel For Any Reason is exactly what it sounds like – the coverage allows you to cancel for any reason that’s not covered by the policy and still receive a reimbursement of your trip cost.

For example, suppose you are concerned about having to cancel your trip due to a border closure or because your destination country stops letting in travelers due to Covid-19. While these are valid concerns for cancellation, cancelling your trip for these reasons would not be covered under a Standard Cancellation plan, such as the UnCruise Travel Protection Plan, Trawick First Class, or IMG Travel SE.

However, a Cancel For Any Reason plan, like Trawick First Class (CFAR 75%), will allow you to cancel your trip for this reason and still be reimbursed 75% of your trip cost.

Many major cruise lines offer Cancel For Any Reason, which assigns a future cruise credit to the travelers if they cancel their cruise for any reason not listed on the policy. Surprisingly, UnCruise does not offer a Cancel For Any Reason option. While a future cruise credit isn’t preferable, it’s better than nothing.

On the other hand, some third-party travel insurance plans, like Trawick First Class (CFAR 75%) have Cancel For Any Reason benefits built into the policy. Instead of offering future credit, the policy gives you a cash reimbursement for a portion of the trip cost.

However, Cancel For Any Reason has a few rules. The coverage reimburses 75% of your pre-paid and non-refundable trip costs, provided you:

- Purchase the policy within 10-21 days (depending on the policy) of your initial payment or deposit towards the trip. For the Trawick First Class (CFAR 75%), this timeframe, called the Time Sensitive Period, is 14 days.

- Insure 100% of your pre-paid and non-refundable trip costs, and add any subsequent payments to the policy’s trip cost within the Time Sensitive Period

- Cancel your trip no later than 48 hours prior to departure

Trip Interruption

Akin to Trip Cancellation, Trip Interruption reimburses you for the unused portion of your trip if you experience a covered interruption. Covered reasons for Trip Interruption mimic those of Trip Cancellation.

We never expect an unforeseen event to arise and interfere with our trip, but sometimes the unexpected happens and we must cut our trip short due to a family emergency. Other times, we may miss out on a day or two of our cruise because we need to seek medical treatment off-ship due to an unexpected injury or illness.

In such cases, travel insurance reimburses you up to your trip cost for the unused, pre-paid, non-refundable expenses for your travel arrangements, plus the additional transportation cost paid to either:

- Join your trip if you must depart after your scheduled departure date or travel via alternate route of travel; or

- Rejoin your trip from the point where your trip was interrupted or return home early

Trip Interruption under the UnCruise plan reimburses up to 150% of your trip cost. Trip Interruption coverage that exceeds 100% is a hallmark of a robust and comprehensive travel insurance policy, so credit must be given to UnCruise Adventures for this.

Likewise, Trawick First Class, IMG Travel SE, and Trawick First Class (CFAR 75%) all offer a 150% benefit for Trip Interruption as well.

Medical Insurance

Carrying proper Medical Insurance when traveling overseas is vital to protect you from incurring massive medical bills, should you need to seek treatment for an unforeseen illness or injury that occurs while on your trip.

Although many of the countries we visit have subsidized medical programs, these programs are almost always for the benefit of their residents and not for visitors. Travelers are typically sent to private medical facilities which can easily cost $3k-$4k per day. As such, suffering a serious illness or accident overseas can become very expensive.

Be advised, Medicare does not pay for treatment outside the US. In addition, many private healthcare plans only reimburse for emergencies. For example, although some Medicare supplements cover up to $50k of emergency treatment abroad, it’s a lifetime limit and you’ll be required to pay 20% of the bill.

Furthermore, the US State Department does not provide any medical support to Americans traveling overseas, which is why carrying adequate Medical Insurance is critical when leaving the country.

Therefore, TripProtectors recommends each traveler carry at least $100k in Medical Insurance when venturing leaving the US.

It's disappointing that the UnCruise Travel Protection Plan only provides an minimal $30k in Medical Insurance, especially considering the price of the plan.

On the other hand, the Trawick First Class and Trawick First Class (CFAR 75%) cover $150k in Medical Insurance, while the IMG Travel SE covers $250k.

Medical Evacuation

If you need transportation to a medical facility due to an illness or injury during your trip, you need Medical Evacuation coverage. Medical Evacuation pays for transportation from the place of an injury or illness to a local hospital. Once you’re stable and the physician treating you determines it’s necessary, the coverage returns you home to the US for further treatment. If your condition is critical and you require ongoing care by a medical team to return home, an air ambulance might be most appropriate.

Medical professionals possess extraordinary skills and experience required for an air ambulance evacuation. Close quarters, air turbulence, time sensitive medical situations, and pressure all make for an exceptionally stressful environment. Medical Evacuation saves lives, but also comes at a high price, which can range from $15k-$25k per hour.

As such, TripProtectors recommends all travelers leaving the US carry a minimum of $250k Emergency Medical Evacuation coverage. Travelers venturing even further from home, to destinations such as Africa, Asia, or beyond, should carry a minimum of $500k.

Luckily, UnCruise’s plan includes an ample $500k in Medical Evacuation. It’s generous coverage that will serve you well and we are delighted to see their plan includes such great coverage.

Similarly, the IMG Travel SE also includes $500k in Medical Evacuation coverage, while the Trawick First Class and Trawick First Class (CFAR 75%) both cover $1m in coverage.

Pre-Existing Medical Conditions

Understandably, the Pre-Existing Condition portion of travel insurance is one of the most confusing to travelers. While health insurance taught us that Pre-Existing Conditions include your entire medical history, that’s rarely the case with travel insurance.

Instead, travel insurance only concerns itself with your medical history for the 60-180 days immediately before you bought travel insurance. If you received treatment, testing, new medications, a medication change, or your physician recommended treatment or testing not yet completed during that window, then you have a Pre-Existing Condition in the eyes of the travel insurance.

Fortunately, all mid-range and top-tier travel insurance plans, as well as some basic policies, offer a Pre-Existing Condition Exclusion Waiver. The waiver brings coverage for Pre-Existing Conditions into the policy when you purchase the policy shortly after paying your initial payment or deposit towards the trip and insure all pre-paid, non-refundable trip costs.

TripProtectors recommends travelers, especially seniors, purchase a travel insurance plan that covers Pre-Existing Conditions whenever possible.

Many travel insurance plans designed for cruise lines don’t offer a waiver. However, we’re happy to report that UnCruise does offer a Pre-Existing Condition Exclusion Waiver when you purchase their travel insurance plan within 21 days of the initial deposit and insure 100% of your pre-paid, non-refundable trip costs.

Of course, this only applies to the travel arrangements you made through UnCruise Adventures. If you reserved airfare through the airline directly, you’d have to purchase a separate policy for that.

Pre-Existing Condition coverage adds substantial value to any insurance plan. It ensures you’re covered for cancellation, interruption, medical treatment, or a Medical Evacuation, if your condition is pre-existing.

In contrast, Trawick First Class and Trawick First Class (CFAR 75%) will offer the Pre-Existing Condition Exclusion Waiver if either plan is purchased within 14 days of your initial payment towards the trip. For the waiver to be applicable, you’d also have to insure 100% of your pre-paid, non-refundable trip costs.

The IMG Travel SE requires that you purchase the policy within 20 days of your initial payment to include the waiver, however, it does not require that you insure 100% of the trip cost.

Conclusion

Overall, the UnCruise Travel Protection Plan offers a number of desirable coverages, such as comprehensive Trip Cancellation and Trip Interruption protection, great Medical Evacuation coverage, and Pre-Existing Condition Exclusion Waiver. However, it does lack in two key areas – Medical Insurance and Cancel For Any Reason.

UnCruise Adventures’ plan offers a low $30k in Medical Insurance, which leaves travelers who select their plan with a financial risk and coverage gaps. That amount is far below our $100k minimum Medical Insurance recommendation, and such low coverage in a critical area diminishes the value of the policy.

Lack of a Cancel For Any Reason option further weakens the UnCruise plan, as many travelers seek the extra piece of mind and flexibility that Cancel For Any Reason policies provide.

Another troublesome point is the high cost of UnCruise’s travel insurance for senior travelers. Travelers aged 70 and above face a steep financial penalty, as they must pay the exorbitant 15.9% insurance fee over their trip cost. Overall, we rate them a 7 out of 10.

Visit TripProtectors first to see your options before committing to the first travel insurance policy you’re offered. You can get a free quote and compare quality travel plans from some of the nations' top travel insurance companies. You save time and money, plus have the option to compare policies from multiple insurers on one site instead of slowly shopping from insurer to insurer.

You won’t find lower prices on the same policy anywhere else, not even with the insurance company directly.

Have questions? We would love to hear from you. Send us a chat, email, or call us at +1(650) 397-6592.

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

Charles Carel

Easy to navigate to purchase the…

Easy to navigate to purchase the insurance.

Daniel

Miranda was excellent

Miranda was excellent. Knowledgeable, friendly and didn’t waste my time. Though your website is excellent, I prefer to speak to a knowledgeable person before purchasing. I’ve purchased from you before. You are my only call when I need insurance.

Milly

Kendall walked me through the policy…

Kendall walked me through the policy before I purchased it. He made policy clear to me and answered my questions. He also waited till I confirmed I received the documents by email. I feel relieved I have travel insurance. Thank you.