Viking Cruises Travel Insurance - 2025 Review

Viking Cruises Travel Insurance

7

Strengths

- Strong insurance partner

- Good Medical Insurance

- Cancel for Any Reason

- Pre-existing Condition Waiver

Weaknesses

- Expensive

- Cancel for Any Reason pays expiring future credit not Cash

- Low Medical Evacuation Coverage

- No Cancel For Work Reason Coverage

- No Interrupt For Any Reason Coverage

Sharing is caring!

Background

Viking Cruises is a leader in luxury river and ocean cruises. Viking also sails expedition ships to remote areas of the world such as the Arctic and Antarctic.

In this review, we’ll detail Viking’s Travel Protection Plan coverage and cost versus comprehensive trip insurance options available on the wider market.

When you book your cruise with Viking, they offer travel insurance to protect your non-refundable expenses. The Viking Cruise Travel Protection Plan includes Cancellation, Interruption, Medical Insurance, Medical Evacuation, Baggage Insurance, Travel Delay and several other benefits.

The policy is underwritten by the United States Fire company, which also underwrites policies for companies TripProtectors partners with.

If you book your Viking cruise through Viking’s website, you have an opportunity to opt-in or opt-out of insurance during the checkout process. However, if you prefer to shop around, simply opt-out. You have plenty of time to check prices before Viking closes insurance enrollment.

Of course, when you buy a travel insurance plan on the wider marketplace, you can buy travel insurance anytime until the day before departure. However, we recommend buying it early so it includes coverage for Pre-existing Medical Conditions. More about this later.

Our Cruise: Waterways of the Tsars

Our chosen cruise is the 13-day Waterways of the Tsars River cruise for two travelers, ages 55 and 60. The tour starts in Moscow and leisurly cruises along the Volga River to St. Peterburg.

We also had several pre-cruise options available: two nights in St Petersburg for $499 per person or three nights in Helsinki for $999 per person. An additional option to spend two nights in Moscow post-cruise for $599 per person is also available. We’ve opted not to include these additions.

After choosing our stateroom, the total cost of the trip is $14,798 for our travelers.

Viking has a nice addon to include airfare in the total trip cost if you choose. Airfare from 150 US cities can be included so you don’t need to shop for airfare.

Economy tickets from your airport of choice are included free. Premium economy seats or business class seats are also available for an additional price. For our trip, we chose Premium Economy airfare from Chicago’s O’Hare airport for an additional $799 per person. Had we chosen business class, it would have added $3499 per person to the trip cost.

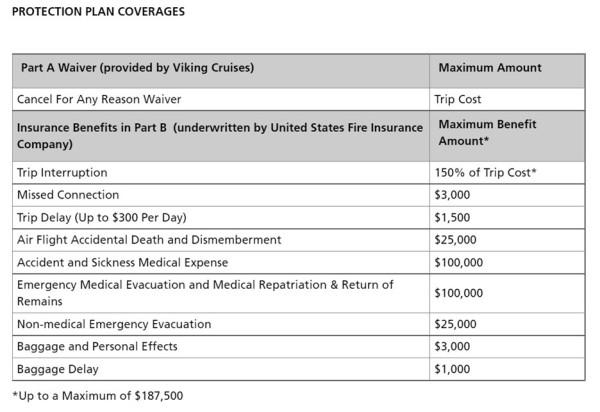

Viking Travel Protection

After choosing or declining airfare, the last set of options we have before checkout is deciding whether to take Viking’s Travel Protection Plan insurance. This plan with Viking, offers travel insurance to protect your non-refundable expenses. The Viking Cruise Travel Protection Plan includes Cancellation, Interruption, Medical Insurance, Medical Evacuation, Baggage Insurance, Travel Delay, and several other benefits.

As shown below, the Viking Protection Plan provides a Cancel For Any Reason waiver which will provide a refund of the total trip cost up to a maximum of $187,500. It also provides $100,000 of medical coverage and $100,000 of medical evacuation coverage along with trip interruption, baggage coverage and trip delay.

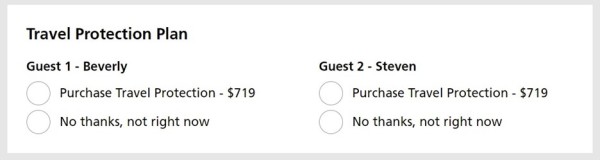

Including or declining airfare will change the amount charged for the insurance if it is selected. Declining airfare or choosing the free economy airfare, the Travel Protection Insurance is $719 per person.

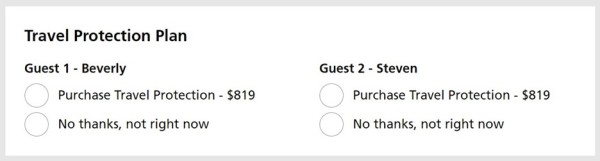

Choosing Premium Economy airfare increases the insurance to $819 per person (See below).

Finally, choosing Business Class airfare increases the insurance to $919 per person (see below).

As we’ve chosen the Premium Economy seating, making our insurance selection $819 per person for a total of $1638 if we choose to add it. Can we find comparable or better travel insurance for a lower cost? Let’s find out.

Comparison Quotes

When shopping for trip insurance, many travelers aren’t sure where to start. We always recommend travelers leaving the US acquire at least:

- $100,000 medical insurance, and

- $250,000 emergency medical evacuation, and

- a Waiver of Pre-existing Medical Conditions.

These levels ensure you’re covered for most medical emergencies overseas.

Next, we compare Viking Cruises travel insurance with two policies available on TripProtectors Travel Insurance Marketplace for our trip cost of $14,798

The least expensive plan that provides at least $100,000 in Medical Insurance, $250,000 in Medical Evacuation and includes a Waiver of Pre-existing Medical Condition is the Trawick First Class for $840.07 for both travelers together.

This plan has $150,000 of medical coverage, which is $50,000 MORE than the Viking policy and $1 million of medical evacuation, which is $900,000 MORE than Viking provides. It is also $597.93 LESS than the Viking Protection Plan. However, one thing the Trawick plan does not have included is a Cancel for Any Reason option added to it. So, let’s look at a version that does.

Let’s consider Trawick First Class (CFAR 75%), because it’s the least expensive plan that includes Cancel For Any Reason. This version of the plan would most closely match the coverages for the Viking Protection Plan. The Trawick First Class (CFAR75%) is the same policy as before but adds the Cancel For Any Reason option.

Let’s look at these three policies side-by-side:

|

Benefit |

Viking Protection Plan |

Trawick First Class |

Trawick First Class(CFAR 75%) |

|

Trip Cancellation |

100% of trip cost |

100% of trip cost |

100% of trip cost |

|

Trip Interruption |

150% of trip cost |

150% of trip cost |

150% of trip cost |

|

Medical Insurance |

$100,000 |

$150,000 |

$150,000 |

|

Medical Evacuation |

$100,000 |

$1,000,000 |

$1,000,000 |

|

Baggage Loss/Damage |

$3,000 |

$500/article up to $2,000 per person |

$500/article up to $2,000 per person |

|

Baggage Delay |

$1000 |

$400 |

$400 |

|

Travel Delay (Incl quarantine) |

$1500 ($300/day) |

$1000 per person |

$1000 per person |

|

Missed Connection |

3,000 |

$1,000 per person |

$1000 per person |

|

Cover Pre-existing Medical Conditions |

Yes if purchased within 14 days of deposit |

Yes if purchased within 14 days of deposit |

Yes if purchased within 14 days of deposit |

|

Cancel For Work Reason |

No |

No |

No |

|

Interrupt For Any Reason |

No |

No |

No |

|

Cancel For Any Reason

|

Yes. Provides travel voucher good for 12 months. |

No |

Yes. 75% of trip cost paid in cash. (must purchase within 10 day s of deposit) |

|

Accidental Death & Dismemberment |

$25,000 (for airflight only) |

$25,000 |

$25,000 |

|

Cost of Policy |

$1638.00 (11.07% of trip cost) |

$840.07 (5.7% of trip cost) |

$1428.12 (9.65% of trip cost) |

Price and Value

First, you can see that Viking cruise travel insurance ($1,638) costs nearly double the standard Trawick First Class policy ($840.07). While Trawick provides $1 million for medical evacuation, Viking’s medical evacuation is only $100,000, which is less than half of what we recommend for this coverage. Low Medical Evacuation coverage can leave you with a large out-of-pocket expense if a medical emergency requires an airlift back home.

Also, notice that Viking’s “cancel for any reason” grants a future credit, not a cash refund. The vouchers expire in 12 months if you don’t use them. By contrast, the Trawick First Class (CFAR 75%) pays a cash refund. If you spent over $14,000 on a trip and only get future credit, that’s a lot of money to sacrifice to vouchers (which only last a year).

For the price, the Viking Cruises’ travel protection plan offers disappointing value.

Trip Cancellation

When you buy travel insurance through a Travel Insurance Marketplace like TripProtectors or directly from the insurer, all benefits listed in the policy are provided by the insurance company.

For Viking cruise trip insurance, Viking, not the insurance company, pays for the Trip Cancellation benefit. In fact, many cruise lines that offer a Cancel For Any Reason waiver pay for the Trip Cancellation section themselves.

Of course, all other benefits such as Medical Insurance, Baggage and the rest are reimbursed by the insurance company, not Viking.

Travel insurance with Trip Cancellation protects your investment in case you must cancel unexpectedly. Every policy has a list of reasons that are covered for a 100% refund if you must cancel.

Viking cruise travel insurance provides a typical list of cancellation reasons found in most travel insurance plans:

- A Sickness, Injury, or death of You, a Family Member, or a person booked with You on the Trip which with respect to any such Sickness or Injury, requires examination and/or treatment by a Physician at the time you cancel Your Trip. The treating physician must certify that the Sickness or Injury will prevent You from taking Your Trip.

- You or a person booked with You on the Trip are quarantined, selected for jury duty, or receive a valid court order to appear as a witness in a third-party legal action (which jury duty or court appearance would be during the time of the Trip), and such impediment to travel remains at the time You cancel Your Trip.

- Your home or the home of a person booked with You on the Trip, or the destination accommodations specified for Your Trip, are made uninhabitable by natural disaster (such as a flood, hurricane, tornado, earthquake, fire, or blizzard) and are reasonably expected to remain uninhabitable during the time of the Trip.

- Your place of employment or the place of employment of a person booked with You on the Trip is damaged due to a natural disaster (such as a flood, hurricane, tornado, earthquake, fire, or blizzard), requiring You or that traveling companion to remain at work instead of participating in the Trip as a result.

- A documented theft of Your passport(s) or visa(s) which is/are not recovered prior to the time that you cancel Your Trip.

- A job transfer (other than a temporary assignment) at Your primary place of employment of 250 miles or more.

- Your documented involvement in a traffic accident while en route to join the Trip which reasonably causes You to miss the Trip departure.

- Unannounced organized labor strike, inclement weather, or mechanical breakdown which delays, for 12 hours or more, the aircraft on which You are scheduled to travel for (or to) the Trip.

- A shutdown of an airport or the air traffic control system which is reasonably expected to prevent you from departing on the Trip.

- You or a person booked with You on the Trip is either (a) called to emergency military duty following a natural disaster (such as a flood, hurricane, tornado, earthquake, fire, or blizzard); or (b) has a previously granted military leave or re-assignment revoked, and either such impediment to travel as described in subparts (a) and (b) remains at the time that You cancel Your Trip.

- You are terminated or laid off Your job by Your employer for whom You have worked for at least one continuous year, and You are unemployed as of the time that You cancel Your Trip.

- Within 30 days of the scheduled Trip departure date, an act of terrorism occurs in a city that is part of the itinerary for Your Trip, and it is deemed a terrorist incident by the United States Government or by the authorities in the country where the act(s) occurred.

If you cancel for any of the reasons listed above, Viking compensates you, not the insurance company.

Of course, Trip Cancellation reimbursement only applies to the money you spent with Viking. If you bought airfare, hotels or excursions through a 3rd party, Viking’s travel insurance leaves you exposed for those losses.

If you must cancel your trip for a reason that’s not covered by the policy, Viking offers credit toward a future cruise, but it must be used within 12 months and may not be used for the initial deposit. Viking calls this feature a “Cancel For Any Reason” Waiver.

You can easily cover all travel arrangements, like cruise fare, airfare, hotels, transfer, excursions, and rental cars with a single policy through TripProtectors. This strategy is much easier to manage and saves you money.

Cancel For Any Reason

As mentioned previously, Viking pays a cash reimbursement if you cancel your trip due to a covered reason.

If you cancel the cruise for any other reason, Viking only offers future credit or vouchers. In fact, cruise lines and tour agencies are notorious for offering future credit instead of cash refunds. Lack of cash refund puts some travelers in a difficult financial position, sometimes when they need money the most.

Cancel For Any Reason travel insurance policies available on TripProtectors do not provide future credit. They will refund in cash.

If you must cancel your trip, cash is the most useful tool. Although Viking calls their feature Cancel For Any Reason, in practice, it’s more like “Postpone For Any Reason.”

Here’s how Viking’s “Cancel For Any Reason” Waiver works:

- The policy must be purchased within 14 days of the initial trip deposit or payment, and

- The “Cancel For Any Reason” Waiver does not become effective until you make full payment for the cruise vacation, and

- The waiver does not cover fees or costs associated with any transportation, accommodations, or other travel services that are not arranged by Viking, and

- If you have other travel insurance, the waiver will be reduced by the amount of any Trip Cancellation amounts paid or payable under any other travel insurance or travel protection plan providing Trip Cancellation benefits.

Then, travel vouchers are subject to the following limitations:

- Viking Cruises travel vouchers may only be used when purchasing transportation, accommodations, or travel services from Viking Cruises, and

- Must be redeemed within 12 months of the date of issue, and

- Such travel vouchers are non-refundable and non-transferable, and

- Will only be issued in the name of the person(s) for whom the Trip were cancelled, and

- Are not redeemable for cash, and

- Viking Cruises travel vouchers may not be used as a credit toward the initial deposit for a future Trip booked through Viking Cruises, or to purchase another Viking Cruises Travel Protection Plan, and

- The value of such travel vouchers will not be reimbursable under the Waiver of any future Viking Cruises Travel Protection Plan that you may purchase.

If that sounds restrictive, it is.

There are a lot of rules about how and when Viking allows you to receive and use your future credit vouchers.

On the other hand, policies available through TripProtectors with the Cancel For Any Reason benefit and are much simpler to understand.

Here’s how they work:

- If you cancel for a reason other than those covered by the policy, you receive 50% or 75% (depending on policy) of your Trip Cost reimbursed in Cash

- Must purchase the policy within 10 - 21 days (depending on policy) of your Initial Trip Payment, and increase your policy coverage within 20 days of any subsequent payments

- Must cover 100% of all trip costs by the policy

- Must cancel the trip 48 hours or more prior to your Departure Date.

That’s all there is to it. Not complicated.

Trip Interruption

Trip Interruption works the same way as Trip Cancellation but occurs when you’re already on your trip.

For example, if you got news from back home that a family member was suddenly hospitalized with a critical illness, you can return home early. The insurance reimburses you for the unused portion of the trip, plus the extra cost of going home early.

Viking Cruises travel insurance covers more reasons for Trip Interruption than for Trip Cancellation.

Covered Interruptions include:

- Covered sickness, injury or death of you, a family member, traveling companion or business partner that occurs during the trip

- Being hijacked, quarantined, required to serve on a jury, or subpoena

- Primary place of residence or destination being rendered uninhabitable by fire, flood, burglary, or other natural disaster

- Documented theft of passports or visas

- Permanent transfer of employment of 250 miles or more

- Being directly involved in a traffic accident on the way to departure

- Unannounced strike of common carrier

- Inclement weather

- Mechanical breakdown of common carrier

- Government-mandated shutdown of an airport or air traffic control system

- Traveler is in the military and called to emergency duty for a national disaster other than war

- Involuntary employer termination or layoff

- Terrorism

- Revocation of previously granted military leave or reassignment due to war

- Your family or friends living abroad with whom you are planning to stay are unable to provide accommodations due to life-threatening illness/injury or death of one of them

- Victim of felonious assault

- Trip is delayed and causes you to lose 50% or more of the scheduled trip duration

Viking cruise trip insurance provides a respectable list of covered interruption reasons. Interestingly, they offer more covered reasons for Trip Interruption than for Trip Cancellation. But it’s not surprising since the insurance company pays for the Interruption, not Viking, who pays for the Cancellation.

Medical Insurance

While most travelers are concerned with losing their investment in the trip, many overlook the importance of Medical Insurance.

A trip cost of $5,000 or $25,000 is a significant purchase. But if a medical emergency occurs during your trip, a hospital bill of $100,000 is a far more devastating loss.

Because medical treatment is expensive everywhere in the world, we recommend all travelers leaving the US to purchase at least $100,000 Medical Insurance.

Some travelers assume Medicare covers them outside the US, but, unfortunately, this is not the case. Medicare does not pay any international providers.

Although some Medicare supplement policies include a $50,000 emergency health insurance, it comes with some restrictions. The benefit is a lifetime limit, not a per trip limit.

In addition, Medicare supplement policies require you to pay a 20% out-of-pocket co-insurance (up to $10,000 of your money). If your primary insurance at home is Medicare and a Medicare supplement, it makes sense to get additional coverage.

Another common misconception is that health care is free in other countries. That’s only half true.

Countries that offer universal health care only provide it to their residents. They pay taxes to fund their national health care program and provide free care at public hospitals. On the other hand, traveling Americans are sent to private hospitals for treatment where you must pay the full price out of pocket.

If you receive treatment at a private medical center, you can expect $3,000 to $4,000 or more for inpatient fees per night, plus additional costs for medicine, tests, treatments, or surgeries. After you worked hard to save for retirement, would you want to risk losing your nest egg to foreign medical care?

One last situation worth noting is that the US State Department does not provide any financial support for medical treatment. Nor do they pay for medical evacuation to bring you home.

This myriad of circumstances is why TripProtectors recommends each traveler take at least $100,000 Medical Insurance when leaving the US.

Looking at Viking Cruise medical insurance, they provide our minimum recommended amount of $100,000 for medical coverage. Very few cruise lines provide such a generous benefit.

If you prefer Medical Insurance with a higher limit, several policies found on TripProtectors have coverage of $150,000, $250,000, and even $500,000.

Emergency Medical Evacuation

Medical Evacuation insurance is the follow on to Medical Insurance. Together, these two benefits provide comprehensive coverage in a medical emergency.

People often dismiss the importance of Medical Evacuation insurance.

Suppose you are healthy and not taking any medication. While on your cruise, you start feeling bad and the crew thinks you are having a stroke. They rush you to the nearest hospital and the doctor confirms a stroke after completing multiple tests.

The doctor says you are stable enough to travel, but not well enough to take a commercial flight home. She orders air transportation home on a medical jet because you’re still at risk and require medical personnel to oversee your vitals.

Medical air transportation can cost $15,000 to $25,000 per flight hour and it’s a 10-hour flight home.. Who will pay for the flight? Your personal health insurance does not cover Medical Evacuation.

But travel insurance does!

Medical Evacuation provides transportation:

- From the point of injury or illness to the closest hospital, and

- From the first hospital to another hospital that is better equipped to treat your condition, and

- Transportation home either by commercial airline or private medical aircraft.

In addition, it includes the return of remains if a traveler dies during their trip.

TripProtectors recommends all travelers leaving the US get at least $250,000 Emergency Medical Evacuation protection.

Sadly, Viking cruises travel insurance falls well short of this recommendation. They include only $100,000 for Medical Evacuation. Since the bulk of their river cruises sail in Europe, their coverage falls short to get a traveler back home.

More worrisome, Viking’s expedition cruises, which travel to very remote locations around the globe, would require even higher Medical Evacuation protection. For trips to the Arctic, Antarctic, Galapagos, and other distant places, we recommend you take at least $500,000 in Medical Evacuation, with $1 million being preferable. Viking’s minimal $100,000 Medical Evacuation amount may not get you back to dry land, much less a hospital in a city.

By contrast, the Trawick First Class provides $1 million of Medical Evacuation and is priced lower than the Viking Protection Plan.

Pre-existing Medical Conditions

Most senior travelers are concerned about whether Pre-existing Medical Conditions could interfere with their travel insurance coverage.

Fortunately, most policies do not look at your entire life’s medical history. Instead, they only concern themselves with the most recent 60-180 days.

They define a Pre-existing Medical Condition as one for which in the past 60-180 days you’ve received treatment, testing, medication change, new medication added, or the doctor recommended treatment or a test that has not occurred yet.

If you have a stable condition that’s been treated for years with medication, and that medication has not changed, and the condition has not worsened, then it would be covered by the policy since it’s older than 60-180 days. Often, people have nothing to worry about regarding conditions like high blood pressure or high cholesterol.

On the other hand, if you recently went to the doctor for treatment, test or medication change of a pre-existing condition, then these conditions may be excluded from coverage.

To make sure your travel insurance covers Pre-existing Conditions, look for a policy with a Waiver of Pre-existing Medical Conditions. This waiver allows the policy to cover your condition if you purchase it within 14-21 days of the Initial Trip Deposit or Payment.

TripProtectors recommends travelers, especially seniors, purchase a travel insurance plan that covers Pre-existing Conditions.

The Viking Protection Plan offers the Waiver of Pre-existing Medical Conditions when you purchase the policy within 14 days of the Initial Deposit. Not all cruise lines provide this coverage, so we were pleased to see the Waiver from Viking.

Keep in mind, Viking isn’t the only insurance that offers a Waiver of Pre-existing Medical Conditions. Most policies available through TripProtectors offer a Waiver, including the Trawick First Class we’ve been discussing.

If you are purchasing the insurance outside of the required time period listed to get the pre-existing medical condition waiver, there are several policies – the Trawick Voyager and the IMG Travel LX, that will provide the waiver if you purchase the policy on or before your final trip payment.

Conclusion

Although Viking Cruises receives high accolades each year for their cruises, their travel insurance falls short of expectations for several reasons:

First, their plan is expensive, and has inadequate coverage the key area of Medical Evacuation, offering only $100,000 when we recommend at least $250,000.

Second, their Cancel For Any Reason waiver only gives you future credit toward cruises, not a cash refund.

Overall, we rate it a 7 out of 10.

Travelers planning a Viking River cruise vacation will find the best value for their money and peace of mind when they shop for travel insurance at TripProtectors Travel Insurance Marketplace. There, you can review dozens of options and select the best policy to fit your needs.

To help you find the best policy, TripProtectors recommends having at least $100,000 in travel medical coverage and $250,000 emergency medical evacuation when traveling outside the US. And, if you purchase the policy within the 14-21 days of initial trip payment, please consider a travel insurance policy with the pre-existing condition waiver included to ensure the most coverage for your money.

If you are planning a Viking River cruise in 2022, be sure to pack insurance before you travel. You never know when you may need it.

Have questions? Chat with us online, send us an email at agent@TripProtectors.com or alternatively call us at +1(650) 397-6592. We would love to hear from you.

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

Lynn

AARDY is great!

Travel Insurance can be daunting to understand. Working with Lauren at AARDY to find the right plan was very streamlined. I asked a ton of questions and Lauren patiently answered each of them. We chose a plan that is perfect for our needs!

Amy

great phone PR Maranda M

great phone PR Maranda M

JOANNE HYLAND

The agent answered all of my questions…

The agent answered all of my questions and took time to explain any of my concerns.