VRBO Travel Insurance - 2025 Review

VBRO Travel Insurance Review

6

Strengths

- Reputable Insurance partner

Weaknesses

- No medical insurance

- No Cancel For Any Reason option

- No Pre-existing Condition benefit

Sharing is caring!

VRBO is an online marketplace for vacation rentals and is owned by Expedia Group.

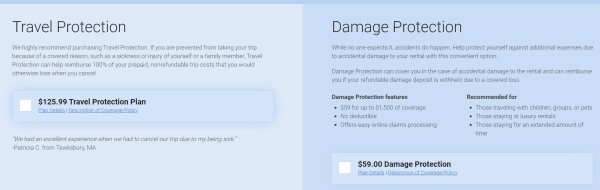

VRBO advises customers to purchase travel insurance after booking the rental property. Generali US underwrites the VRBO policy, which offers a trip cancelation policy and a property damage add-on policy.

The damage protection program add-on policy covers $1,500 in property damage liability if you accidentally damage the property. Most travel insurance policies do not cover liability since it's not a standard travel hazard.

However, at TripProtectors, we offer the Trawick First Class, which includes a $5,000 Accommodation Property Damage benefit. It provides reimbursement for direct physical damage to covered real or personal property within the unit occupied by the insured during the trip.

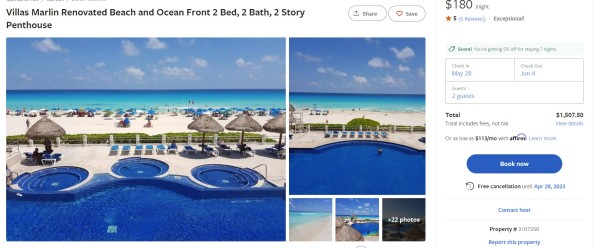

Our VRBO Booking

For this review, our sample couple aged 55 and 60 have booked a beachfront rental in Cancun, Mexico, from May 28 – June 4.

The cost of the rental is $1,799.87 with the cleaning fee, service fee and taxes.

Here is the offer from VRBO's travel insurance page:

If they insure the condo rental through VRBO trip insurance, the cost is $125.99 and they can add $1,500 of damage protection for an additional $59 bringing the total insurance cost to $184.99.

Is this a good value? Let's find out.

What Does VRBO Insurance Include?

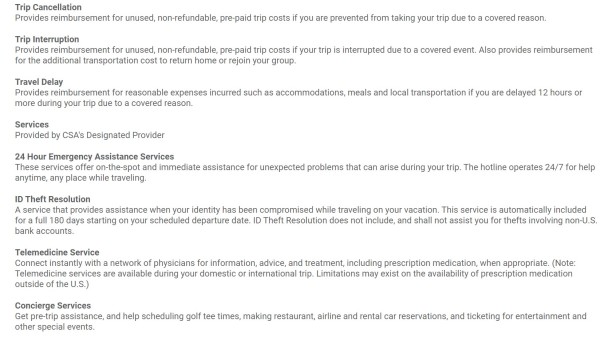

The policy provides trip cancellation and trip interruption as well as travel delay but medical coverage is not offered.

Is anything more comprehensive available in the open marketplace? Let’s see…

A Quote From TripProtectors

Inputting our trip details into the quoting system at TripProtectors, we’re presented with 28 quotes to choose from.

Since we’re traveling internationally, TripProtectors recommends having at least $100,000 of medical coverage and $250,000 of medical evacuation coverage – coverage not even offered in the VRBO policy.

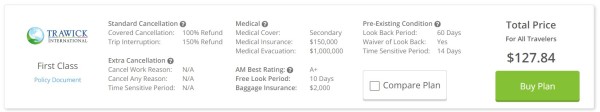

The least expensive plan on our quote with adequate coverage is the Trawick First Class for $127.84.

The policy provides $150,000 of medical coverage and $1 million of medical evacuation coverage as well as trip cancellation, trip interruption and a waiver of pre-existing medical conditions if the policy is purchased within 14 days of the initial trip payment or deposit date. This plan also includes $5,000 of property damage.

The Trawick policy is $54 LESS than the VRBO policy with the added damage protection and includes medical coverage and medical evacuation! Also, we can include other non-refundable costs such as airfare and tours to the trip cost and have those covered as well.

If we cancel for a listed reason in the policy, such as illness or injury, we’ll receive 100% of our trip costs back.

What if we want to have maximum flexibility to cancel our trip for ANY reason and not just the reasons listed in the policy?

For maximum cancellation flexibility, we’ll need to look at a different policy – a Cancel For Any Reason (CFAR) policy.

TripProtectors – Cancel For Any Reason (CFAR) Policies

As the name suggests, Cancel For Any Reason (CFAR) policies allow you to cancel for any reason whatsoever and receive a partial refund of trip costs – either 50% or 75% depending on the policy purchased. These policies allow maximum cancellation flexibility.

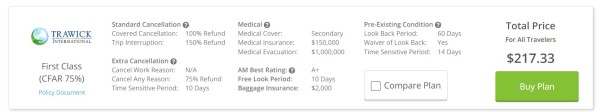

Looking at the quote from TripProtectors, the least expensive CFAR policy with adequate coverage for our trip is the Trawick First Class (CFAR 75%) for $217.33.

The policy provides the same coverage as the standard Trawick First Class policy of $150,000 of medical coverage and $1 million of medical evacuation coverage as well as provides a waiver to cover pre-existing medical conditions if the policy is purchased within 10 days of the initial trip payment or deposit date. Pricewise the policy is $32 more than the VRBO policy with the added damage protection, but includes medical coverage, medical evacuation and a waiver of pre-existing medical conditions which the VRBO policy doesn’t have.

If we cancel for a listed reason such as illness or injury, we’ll get a 100% refund of our trip costs but if we use a non-listed reason, we’ll get a 75% refund.

VRBO Insurance Summary

First, VRBO travelers save over $50 on travel insurance by working with TripProtectors and enrolling in the Trawick First Class policy. Not only do they save money, but they also get much more coverage than the VRBO policy provides, including medical and medical evacuation coverage.

If more cancellation flexibility is desired, for a few dollars more, they can get a Cancel For Any Reason policy. It allows cancellation with a refund for any reason not listed in the plan and adds excellent medical and medical evacuation coverage.

We would not recommend any VRBO insurance option because it does not offer a Waiver of Pre-existing Conditions, nor does it offer medical or medical evacuation coverage. We advise anyone taking out travel insurance shop the open marketplace to see what other options are available.

Get an Insurance Quote For Your VRBO Rental

When you shop at TripProtectors you can compare quotes and policies from many top-rated travel insurance carriers.

Speak with one of our licensed travel insurance experts at +1(786) 589-8254, by email or by live chat.

Safe Travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

Inna C

Very good experience

The agent was very pleasant, polite, answered all questions.

Robert

Website easy to navigate

Website easy to navigate. AARP discount was a plus.

AS

Quick response

Quick response to my request for quotes. I especially appreciated the occasional automatic email reminders to decide on a policy. Most people would consider these reminders as pestering, I saw them as gentle reminders to my procrastination. Thanks