Windstar Cruises Travel Insurance - 2025 Review

Windstar Cruises Travel Insurance - Review

7

Strengths

- Cancel For Any Reason Coverage

- Pre-Existing Condition Waiver on Premium Plan

Weaknesses

- Weak Medical Insurance & Evacuation Coverage

- High Cost

- Cancel For Any Reason Does Not Pay Cash

- Standard plan does not cover Pre-Existing Conditions

Sharing is caring!

Windstar Cruises is a leader in small-ship cruising. With less than 350 travelers per ship, Windstar provides an intimate and refined travel experience to popular ports in over 60 countries.

Windstar Cruises’ brand of travel insurance is called Full Sail Travel Protection, which comes with two options: Premium and Standard. Both options are administered by Aon Affinity Travel Practice and underwritten by Arch Insurance Company.

Windstar employs a unique travel insurance pricing system. They charge a flat fee of 11% of the trip cost for the Premium Plan, and 9% of the trip cost for the Standard Plan.

In this article, we provide an overview of both Windstar plans, break down the coverages, and show you other travel insurance options on the wider travel insurance market.

Our Trip: Comprehensive Spain – Barcelona to Bordeaux

For our example, we selected the Barcelona to Bordeaux package, a 12-day cruise aboard the Star Legend that sails from 5/6/22-5/18/22. The cruise begins in Barcelona, Spain, and ends in Bordeaux, France, with stops in Gibraltar, Seville, and more, along the way.

Our sample couple, ages 55 and 60, selected the Ocean View Suite, which puts the trip cost for two travelers at a total of $9,356. To add Windstar’s Full Sail Travel Protection, it will cost an additional $1,029.16 for the Platinum Plan or $842.04 for the Standard Plan

Let’s see how that compares to alternative options available on the wider travel insurance marketplace.

Comparison Quotes

Carrying adequate coverage when traveling abroad protects you from the possibility of paying for emergency medical treatment out-of-pocket or even incurring a 6-figure transportation fee to be medically evacuated home in a worst-case scenario.

Therefore, TripProtectors consistently recommends that all travelers heading overseas secure a policy with minimum of $100k Medical Insurance, $250k Emergency Medical Evacuation, and a Waiver of Pre-Existing Medical Conditions whenever possible. This is the primary benchmark we use to determine if a cruise line’s travel insurance plan is up to par. Travel insurance policies that meet the minimum limits listed above provide substantial coverage for most medical emergencies.

Whenever we review cruise line insurance plans, we always compare them to policies available at TripProtectors. That way, you’re able to see how the coverages compare, whether they fit your needs, and are a good value for your money.

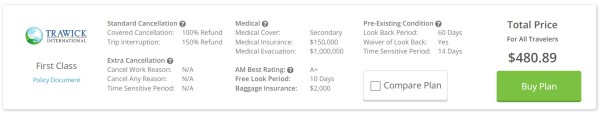

First, we compared the Full Sail Travel Protection Plan to Trawick First Class, because at $480.89, it’s the least expensive plan that meets our minimum recommendations for travel outside of the US and costs $548.27 less than the Platinum Plan offered by Windstar. It even costs $361.15 less than Windstar’s Standard Plan.

Next, we compared it to John Hancock Silver (CFAR 75%) for $802.50, because it’s the least expensive option that both meets our minimum recommendations and includes Cancel For Any Reason.

Occasionally, travelers require maximum flexibility from an insurance plan. In those situations, a policy that provides Cancel For Any Reason will be most suitable. Even with the Cancel For Any Reason feature included, this plan costs $226.66 less than Windstar’s Premium Plan and $39.54 less than the Standard Plan.

We’ll discuss Cancel For Any Reason further in the article, but first, let’s see how each plan compares, side-by-side.

|

Benefit |

Full Sail Travel Protection Premium |

Full Sail Travel Protection Standard |

Trawick First Class |

John Hancock Silver (CFAR 75%) |

|

Trip Cancellation |

100% of trip cost |

100% of trip cost |

100% of trip cost |

100% of trip cost |

|

Trip Interruption |

100% of trip cost |

100% of trip cost |

150% of trip cost |

150% of trip cost |

|

Medical Insurance |

$50,000 |

$10,000 |

$150,000 |

$100,000 |

|

Medical Evacuation |

$100,000 |

$25,000 |

$1,000,000 |

$500,000 |

|

Baggage Loss/Damage |

$3,000 |

$1,500 |

$500/article, up to $2,000 |

$250/article, up to $1,000 |

|

Baggage Delay |

$500 |

$500 |

$400 |

$500 |

|

Travel Delay (Incl quarantine) |

$1,000 ($100/day) |

$500 ($100/day) |

$1,000 |

$750 ($150/day) |

|

Missed Connection |

No |

No |

$1,000 |

$750 |

|

Cover Pre-existing Medical Conditions |

Yes, if purchased within 14 days of deposit |

No |

Yes, if purchased within 14 days of deposit |

Yes, if purchased within 14 days of deposit |

|

Cancel For Work Reason |

No |

No |

No |

No |

|

Interrupt For Any Reason |

No |

No |

No |

No |

|

Cancel For Any Reason

|

Yes, 90% future cruise credit |

Yes, 50% future cruise credit |

No |

Yes, if purchased within 14 days of deposit |

|

Accidental Death & Dismemberment |

No |

No |

$10,000 (24 hour) |

$100,000 (24 hour) |

|

Cost of Policy |

$1,029.16 |

$842.04 |

$480.89

|

$802.50 |

When we compare all four insurance plans, both Windstar plans show their weaknesses quickly. While their Platinum Plan clearly provides better coverage over the Standard Plan, $50k in Medical Insurance and $100k in Medical Evacuation coverage is simply not enough for international travel.

On the other hand, Trawick First Class covers $150k in Medical Insurance and $1m in Medical Evacuation coverage, while John Hancock Silver (CFAR 75%) covers $100k in Medical Insurance and $500k in Medical Evacuation coverage. These levels of coverage are much more suitable for travel outside of the US, and both plans cost less than either Windstar plan.

Luckily, both Windstar plans include Cancel For Any Reason, but only offer a future cruise credit when exercising that benefit. On the other hand, John Hancock Silver (CFAR 75%) also includes Cancel For Any Reason, and will provide a cash reimbursement, rather than a future credit.

Now, we’ll discuss each of these coverages more in depth.

Trip Cancellation

No one plans on cancelling their trip, but sometimes situations arise that force you to do so. When life interferes with your travel plans, Trip Cancellation reimburses you for the full cost of the trip if you cancel for a covered reason.

Windstar Cruises permits a 100% cash refund for the following covered cancellation situations:

- Sickness, injury or death to yourself, a traveling companion, or members of either of your immediate families which is diagnosed and treated by a physician at the time your cruise vacation is terminated;

- Involvement in a traffic accident en route to departure that causes you to miss your cruise vacation;

- Your home, destination, or workplace is made uninhabitable by, or you are called into emergency military duty due to, a natural disaster such as flood, earthquake, hurricane, volcano, tornado, wildfires or blizzard;

- Being called to serve jury duty or subpoena;

- Your passports or visas have been stolen;

- Your military leave is revoked;

- Bad weather, unannounced strike or mechanical breakdown occurs which lasts 12 hours which prevents you from reaching your cruise destination;

- Flights are grounded by air traffic control or a government-mandated shutdown of the airport;

- You are laid off or your job is terminated by your employer of one year or greater;

- You are permanently transferred 250 miles or more by your employer; or

- A terrorist incident (as deemed by the US government) occurs in a city listed on your itinerary within 30 days of your cruise vacation.

The reasons listed above are typical covered reasons found in travel insurance plans, so we’re pleased to see Windstar covers these reasons as well.

However, one key reason is missing from the list above: bankruptcy or financial default of the travel supplier. If Windstar Cruises goes bankrupt, you’ll lose your trip cost, even if you opted to purchase their travel protection plan.

Trawick First Class and John Hancock Silver (CFAR 75%) both cover all the reasons above and more, including bankruptcy or financial default of the travel supplier. John Hancock Silver (CFAR 75%) also includes the added benefit of allowing you to cancel for any reason outside of what’s covered under the policy, and still receive a significant reimbursement of your trip cost.

Worth noting, Windstar’s plans limit the amount they’ll cover for Trip Cancellation and Trip Interruption. The Standard Plan only covers up to a $10k maximum trip cost per traveler. That’s a painfully low ceiling, as most policies cover between $50k to $100k per traveler. The Premium Plan provides trip cost protection up to a $75k maximum for each traveler, which is much more suitable.

Cancel For Any Reason

A Cancel For Any Reason plan allows you to cancel for any reason not otherwise covered by the policy and still receive a reimbursement of your trip cost.

For example, suppose you are concerned about the uncertainty of Covid-19 and want to have coverage to cancel your trip if you decide you’re not comfortable traveling as it gets closer to your travel dates. Or perhaps you’re worried that there will be border closures or travel restrictions, rendering your travel plans moot. While these are all valid concerns, these concerns are not covered under standard travel insurance plans.

However, a plan that includes Cancel For Any Reason will allow you to cancel for the reasons listed in the example above, or any other reason not covered by the underlying policy, and still receive a reimbursement of your trip cost.

We’re always pleased when a cruise line offers Cancel For Any Reason, however, Windstar’s plans only reimburse a future cruise credit, rather than cash.

Windstar’s Cancel For Any Reason provides you with:

- A future cruise credit for 90% of your trip cost with a $75k maximum under their Platinum Plan

- A future cruise credit for 50% of your trip cost with a $10k maximum under their Standard Plan

We prefer travelers to receive a cash refund, as it is more useful and does not expire, but a future cruise credit is certainly better than nothing. However, future cruise credits are a poor substitute for real money when you pay such a high premium for Windstar’s travel protection.

On the other hand, some third-party travel insurance plans, like John Hancock Silver (CFAR 75%) have Cancel For Any Reason benefits built into the policy. Instead of offering future credit, the policy gives you a cash reimbursement for a portion of the trip cost.

Although, Cancel For Any Reason has a few rules to follow. The coverage reimburses 75% of your pre-paid and non-refundable trip costs, provided you:

- Purchase the policy within 10-21 days (depending on the policy) of your initial payment or deposit towards the trip. For the John Hancock Silver (CFAR 75%), this timeframe, called the Time Sensitive Period, is 14 days.

- Insure 100% of your pre-paid and non-refundable trip costs, and add any subsequent payments to the policy’s trip cost within the Time Sensitive Period

- Cancel your trip no later than 48 hours prior to departure

Trip Interruption

Similar to Trip Cancellation, Trip Interruption reimburses you for the unused portion of your trip if you experience a covered disruption. Covered reasons for Trip Interruption mimic those of Trip Cancellation.

We never expect an unforeseen event to arise and interfere with our trip, but sometimes the unexpected happens and we must cut our trips short due to a family emergency. Other times, we may miss out on a day or two of our cruise because we need to seek medical treatment off-ship due to an unexpected injury or illness.

In such cases, travel insurance reimburses you up to your trip cost for the unused, pre-paid, non-refundable expenses for your travel arrangements, plus the additional transportation cost paid to either:

- Join your trip if you must depart after your scheduled departure date or travel via alternate route of travel; or

- Rejoin your trip from the point where your trip was interrupted or return home early

Trip Interruption under both Windstar plans reimburses up to 100% of your trip cost. You’ll notice Trawick First Class and John Hancock Silver (CFAR 75%) provide a 150% reimbursement for a covered Trip Interruption. The extra 50% helps with added transportation costs.

Trip Interruption coverage that exceeds 100% is a hallmark of a robust and comprehensive travel insurance policy.

Medical Insurance

Having adequate Medical Insurance coverage when traveling overseas is vital to protect you from being left on the hook for medical bills, should you need to seek treatment for an unforeseen illness or injury that occurs while on your trip.

While many of the countries we visit have subsidized medical programs, these programs are almost always for the benefit of their residents, not for travelers. Private medical facilities can easily cost $3k-$4k per day. As such, suffering a serious illness or accident overseas can become very expensive.

It's worth noting that Medicare does not pay for treatment outside the US. In addition, many private healthcare plans only reimburse for emergencies. For example, although some Medicare supplements cover up to $50k of emergency treatment abroad, it’s a lifetime limit and you’ll be left to pay 20% of the bill.

Furthermore, the US State Department does not provide any medical support to Americans traveling overseas, which is why carrying adequate Medical Insurance is critical when leaving the country.

Therefore, TripProtectors recommends all travelers obtain at least $100k in Medical Insurance when venturing outside the US.

Aside from the premium, one of the biggest differences between the two Windstar plans, Trawick First Class, and John Hancock Silver (CFAR 75%) is the Medical Insurance.

Specifically, both Windstar plans provide woefully insufficient Medical Insurance.

Windstar’s Standard Plan only covers a mere $10k in Medical Insurance. That is simply not enough coverage to protect you in a worst-case scenario, such as a serious accident or heart attack overseas. We’re shocked that a luxury line like Windstar Cruises offers such dismal Medical Insurance, especially considering the cost of their plan.

Windstar’s Premium Plan steps up the Medical Insurance coverage with a limit of $50k. While that’s far better than what their Standard Plan offers, it’s still not enough to ensure you’re covered for an emergency. Further, it’s mid-range coverage with a top-end price tag.

Alternatively, Trawick First Class exceeds our minimum recommendation by offering $150k in Medical Insurance, while John Hancock Silver (CFAR 75%) covers $100k.

Medical Evacuation

Have you ever seen a helicopter land on a cruise ship to pick up a sick passenger, or heard of someone being flown home in a private medical jet? These things happen more frequently than you think.

Specifically, Medical Evacuation coverage pays for transportation from the place of injury or illness to a local hospital. Once you’re stable and the physician treating you determines it’s necessary, Medical Evacuation transports you home for further treatment. If your condition is critical and you require ongoing care by a medical team to return home, an air ambulance outfitted as a flying ICU may be most appropriate.

Private air transportation such as this can cost $15k to $25k per flight hour and coming back to the US from overseas can get very expensive, very quickly.

Because of this, TripProtectors recommends all travelers leaving the US carry a minimum of $250k Emergency Medical Evacuation coverage. For those traveling even further from home to destinations such as Africa, Asia, or beyond, should carry a minimum of $500k.

Disappointingly, Windstar continues its trend of deficient coverage when it comes to Medical Evacuation as well. The Standard Plan has an abysmally low limit of $25k, which will only afford you an hour of private air transport, if you’re lucky.

Windstar’s Platinum Plan once again provides better coverage over their Standard Plan, but only covers $100k for Medical Evacuation, which is still not enough.

However, Trawick First Class covers a generous $1m in Medical Evacuation coverage, while John Hancock Silver (CFAR 75%) covers $500k.

Pre-Existing Medical Conditions

The Pre-Existing Condition portion of travel insurance is one of the most confusing to travelers. Although typical health insurance has taught us that Pre-Existing Conditions include anything that’s occurred throughout your entire medical history, that’s rarely the case with travel insurance.

Instead, travel insurance only concerns itself with your medical history for the 60-180 days immediately before you purchased the policy. If you received treatment, testing, new medications, a medication change, or your physician recommended treatment or testing not yet completed during that window, then you have a Pre-Existing Condition in the eyes of travel insurance.

Fortunately, all mid-range and top-tier travel insurance plans, as well as some basic policies, offer a Pre-Existing Condition Exclusion Waiver. The waiver brings coverage for Pre-Existing Conditions into the policy when purchased shortly after paying your initial payment or deposit towards the trip and, in most cases, insure all pre-paid, non-refundable trip costs.

Consequently, TripProtectors recommends travelers, especially seniors, purchase a travel insurance plan that covers Pre-Existing Conditions whenever possible.

Many cruise line travel insurance plans don’t offer a waiver, so we’re happy to report that Windstar’s Platinum Plan does indeed offer a waiver, if purchased within 14 days of your initial payment or deposit. The Standard Plan, however, does not include a waiver.

In comparison, Trawick First Class and John Hancock Silver (CFAR 75%) automatically include the waiver if either policy is purchased within 14 days of your initial payment or deposit. While Trawick First Class requires all pre-paid and non-refundable trip costs to be insured for the waiver to be applicable, John Hancock Silver (CFAR 75%), does not have that requirement.

Conclusion

First, let’s look at a quick recap of the travel protection plans offered by Windstar Cruises.

Standard Plan Recap:

- $10k Medical Insurance

- $25k Medical Evacuation

- Includes Cancel For Any Reason (future cruise credit for 50% of trip cost)

- No Pre-Existing Condition Waiver

Platinum Plan Recap:

- $50k Medical Insurance

- $100k Medical Evacuation

- Includes Cancel For Any Reason (future cruise credit for 90% of trip cost)

- Pre-Existing Condition Waiver included if purchased within 14 days of deposit

Closer inspection of Windstar’s Full Sail Travel Protection shows where coverage is lacking the most: Medical Insurance and Medical Evacuation, which are arguably the most critical aspects of a travel insurance plan.

While the Platinum Plan does offer better coverage than the Standard Plan, the levels of coverage offered under both plans are still utterly insufficient for international travel.

The Standard Plan is further weakened by not offering coverage for Pre-Existing Conditions, however, Windstar remedies this by offering that coverage under their Platinum Plan if the plan is purchased within 14 days of your deposit.

Luckily, both plans include Cancel For Any Reason, but only offer a future cruise credit if exercising that benefit. While a future cruise credit isn’t preferable, it’s better than nothing at all, so we’re happy to see Windstar offers Cancel For Any Reason in the first place, even though the Standard Plan only provides a credit of 50% of your trip cost, while the Platinum Plan offers a credit of 90%.

The Windstar’s Standard Plan is an deficient plan for the high cost and will leave you with significant gaps in coverage. The Platinum Plan is a much better option over the Standard, but still does not meet our minimum recommendations, and comes at a high premium. Overall, we rate Windstar’s insurance a 7 out of 10.

You’re better served seeing what other options are available on the wider marketplace, such as Trawick First Class or John Hancock Silver (CFAR 75%). You’re more likely save money and find better coverages by doing so.

Visit TripProtectors first to see your options before committing to the first travel insurance policy you’re offered. You can get a free quote and compare quality travel plans from some of the nations' top travel insurance companies. You save time and money, plus have the option to compare policies from multiple insurers on one site instead of slowly shopping from insurer to insurer.

You won’t find lower prices on the same policy anywhere else, not even with the insurance company directly.

Have questions? We would love to hear from you. Send us a chat, email, or call us at +1(650) 397-6592.

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

customer

Miranda is awesome.

This is our third time purchasing trip insurance through AARDY and every year it’s been a great experience. This year we spoke with Miranda - she was so friendly and knowledgeable and hard to imagine but we actually had a good time purchasing insurance. Aardy has found us a way better, cheaper plan than we previously had. We’ll definitely be back next year.

Cheryl Korba Long

Simple to use

Simple to use. Simple to compare policies.

Rilinda Paschal

After choosing Aardy

After choosing Aardy, the process was easy. Good to have coverage out of country.